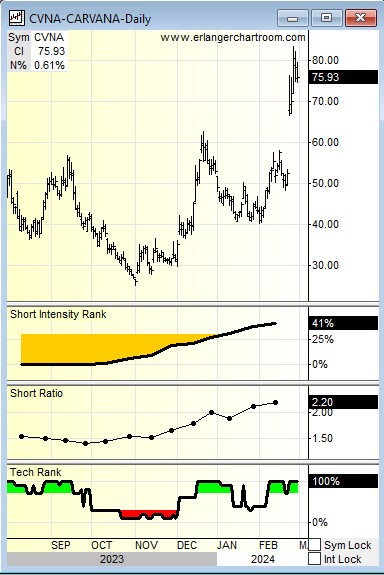

Back on October 4th, we listed the biggest winners for the year. Top of the list was Carvana up 786% at a price of $38.21. Almost five months later the stock is now at $76.12, almost a 100% gain since October!

Most pundits blame this on shorts that were forced to cover. Nothing could be further from the truth.

The chart above shows Short intensity has risen from 0% to 41% and the short ratio has gone from 1.47 to 2.20.

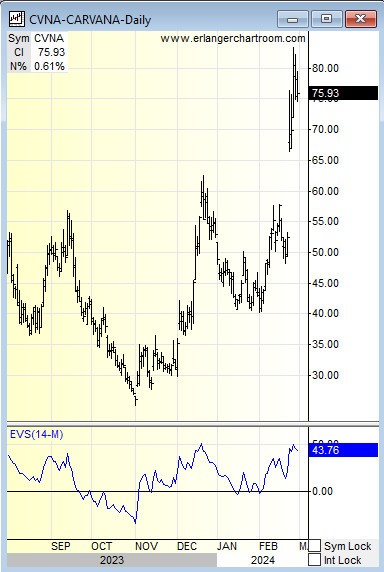

Hardly, a short squeeze. Rather the Erlanger Volume Swing (EVS) below shows constant buyers in the stock when above 0. Sometimes it is that simple!!

Key to being a successful short seller is knowing when the buying is done. Clearly, that has not been the case here.

Where does it end? We do not know but we will continue to watch this name closely.

_______________

Geoff Garbacz is a principal at Quantitative Partners, Inc. and works with several independent research firms that work with buyside clients, financial advisors and institutional investors.