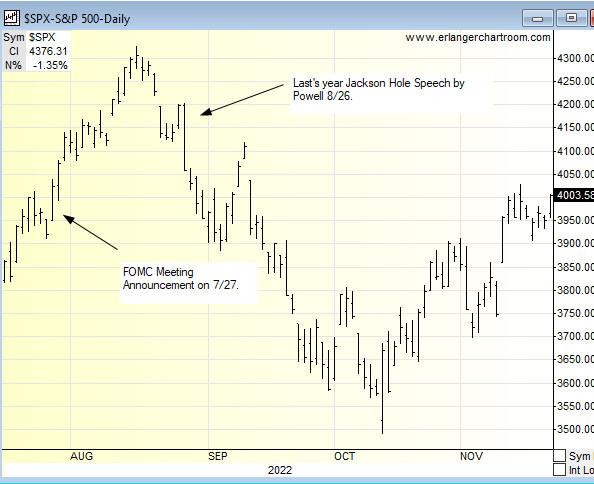

Last week we noted here that stocks had been selling off since the end of July. This action was the first decent selling action we had seen since the March low. A week later has much changed? Not really.

The S&P 500 finished last week down for a third week in a row. Right now this week sees the S&P 500 higher by 0.15% after dropping -1.35% yesterday killing the strong week through Wednesday, up by 1.52%.

Last week we looked at the retracement on SPY, QQQ, IWM amd TLT. SPY and QQQ have still yet to test their 38.2% retracement. Yet IWM has tested both its 38.2% and 50%.

.jpg.aspx;)

TLT has retested its October 24th closing low in the last week which is a plus for now. The rate increase has stalled for now but we have Federal Reserve Chairman Jerome Powell's Jackson Hole Speech later this morning.

Last year his speech from Jackson Hole which is annually given led to a two-month selloff in stocks. Will we see the same result this year?

Unlikely, as last year stocks rallied into Jackson Hole after dovish comments by Powell at the July Federal Reserve Open Market Committee (FOMC) Meeting that sparked a rally. This year has seen stocks sell off hard into the speech as the S&P 500 has fallen 13 days in August, equaling its 10-year August number of down days.

__________________________________

Geoff Garbacz is a principal at Quantitative Partners, Inc. and works with several independent research firms that work with buyside clients, financial advisors and institutional investors.