Crypto is testing investors’ patience...

The bull market has ground to a halt. It’s already been six months since bitcoin (BTC) made new highs.

Worse still, bitcoin declined 22% during this time. Ethereum (ETH) dropped 40%. And many smaller cryptos plunged even more.

In times like these, it’s important not to panic and to look at the big picture…

See, volatility is par for the course when it comes to investing in crypto.

In fact, this is bitcoin’s sixth 20%+ sell-off since bottoming in late 2022. In other words, this pullback is perfectly normal.

Moreover, market fundamentals look robust. In fact, the situation today reminds me of 2020...

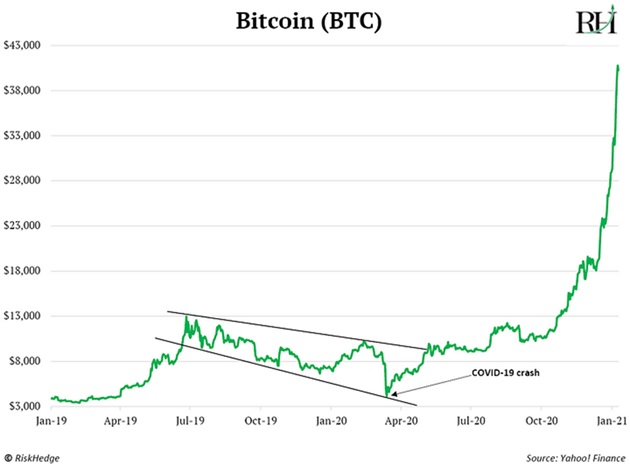

Bitcoin’s price action looks the same as it did around the 2020 COVID-19 crash.

Bitcoin was trending down and then fell out of bed when the pandemic shut the world down.

That was the final flush-out before crypto ripped higher:

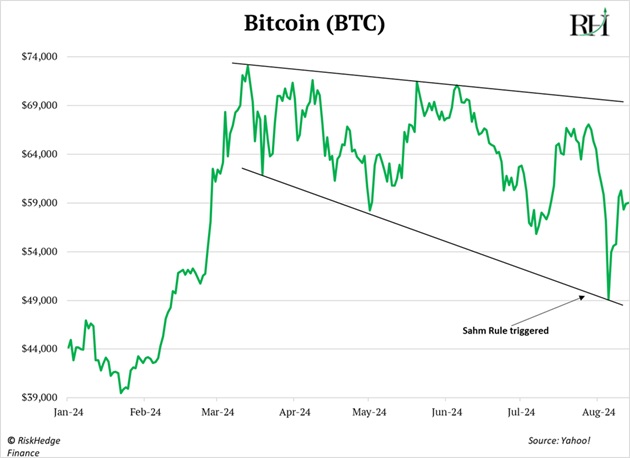

You can see the same broadening wedge pattern playing out in 2024:

Bitcoin fell to around $49,000 shortly after the Sahm Rule was triggered and fears of a recession became rampant.

I agree: recession risks are higher than they’ve been in a long time. But according to Atlanta Fed’s GDPNow, the US economy continues to grow at a healthy 2%. The market is overreacting.

Another factor that echoes 2020 is the coming tidal wave of liquidity.

In plain English, that means “central banks pumping money into the system.”

The US Federal Reserve recently indicated it’s likely to cut interest rates in September. Europe’s central bank already lowered rates. And Japan did a U-turn on rate increases after the market meltdown.

Cue a liquidity injection, which is the lifeblood of risk assets—especially crypto. In fact, the money printers have already started humming. You can see the global money supply is breaking out to new highs:

Source: TradingView

Bullish.

Like 2024, 2020 was also an election year…

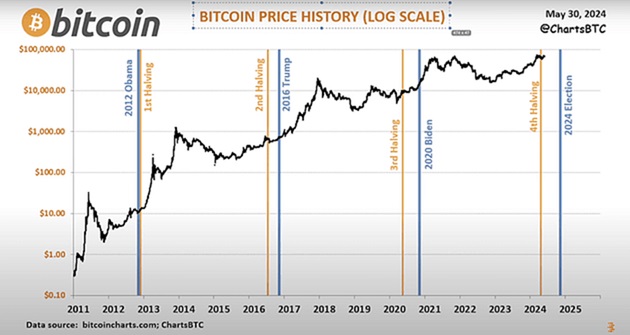

Crypto prices tend to follow a predictable pattern around US elections

Historically, bitcoin trades sideways going into US elections… followed by a strong rally after the die is cast:

Source: ChartsBTC

Will this pattern repeat itself this year? It depends on which candidate wins.

During previous elections, crypto policies weren’t a big part of the debate. But they are this time.

Crypto prices surged alongside Trump’s odds of winning the White House.

Trump is far more pro-crypto than the current administration. He plans to end the regulatory crackdown against crypto… fire hostile SEC Chairman Gary Gensler… and encourage bitcoin mining in America.

But if Kamala Harris wins, we’re likely to see even more stifling regulation lobbed at crypto.

So Trump is generally a better choice for crypto overall.

If Harris wins, crypto will struggle though Bitcoin and Ethereum should still profit (if not as much) because of the infinite bid from crypto ETFs.

Overall, the backdrop for crypto is bullish.

My research suggests crypto prices have likely bottomed, and bitcoin’s price will range between $50,000 and $70,000 until after November’s US presidential election.

Here’s my final piece of guidance: Don’t invest any money into crypto that you can’t afford to lose.

Crypto is just one asset in an overall portfolio. I recommend putting around 1% to 2% of your total assets into crypto—and definitely no more than 5%.

Before you buy, ask yourself: “What if this position loses 50% of its value by next week?” If this would stress you out, you’re investing too much.

In volatile assets like crypto, you need “staying power” to remain invested while prices are swinging around. The best way to have staying power is to keep your position sizes small.

For more insights on the crypto market and other disruptive megatrends, consider subscribing to my free investing letter The Jolt—where innovation meets investing. I publish fresh research every M/W/F. Click here to join.

_______________

Stephen McBride is Chief Analyst, RiskHedge. To get more ideas like this sent straight to your inbox every Monday, Wednesday and Friday, make sure to sign up for The Jolt, a free investment letter focused on profiting from disruption.

Expect smart insights and analysis on the latest breakthrough technologies, the big stories the mainstream media isn't reporting on, and much more... including actionable recommendations.

Click here to sign up.