AI stocks are in recovery mode.

A few weeks ago, Chinese startup DeepSeek shocked the world with its new artificial intelligence (AI) model R1.

It was the first Chinese AI model that matched—and even exceeded—the capabilities of US rivals like ChatGPT.

DeepSeek also claimed it trained its breakthrough model for just $6 million. That’s a fraction of the billions of dollars spent by US companies.

This caused investors to ask, “If AI just got drastically cheaper, why do we need all those expensive chips and data centers?”

The market panicked and AI stocks sold off hard. Nvidia (NVDA) shed nearly $600 billion—the biggest one-day loss in US stock market history.

But as I’ll show you, the market got the DeepSeek news completely wrong.

- DeepSeek isn’t a threat to the AI boom. It’s rocket fuel.

What I love about AI is that you don’t have to take anyone’s word for it. You can open your laptop and get your hands dirty with it.

I tested DeepSeek’s model. It’s on par with Alphabet (GOOG) and OpenAI’s best. The big difference is that DeepSeek is free and open source.

But the idea it only cost $6 million to train is a myth.

In its research paper, DeepSeek clearly states that figure represents only the final training run of its R1 model. It excludes all R&D costs… previous experimental runs and testing… data acquisition and processing… and employee salaries and overhead.

Saying DeepSeek built this model for $6 million is like claiming you can build a house for the cost of hammering in the last nail.

DeepSeek also claimed it trained R1 using cheaper, less powerful Nvidia chips. This is another myth.

My team and I analyzed earlier DeepSeek papers, which referenced having access to at least 10,000 high-end GPUs. Industry experts—including Scale AI’s CEO and SemiAnalysis’ Dylan Patel—estimate DeepSeek has access to roughly 50,000 premium Nvidia chips.

That means DeepSeek spent upward of $500 million on its AI infrastructure.

Why lie? The US government banned the sale of Nvidia’s latest chips to China a few years ago. Admitting to having these cutting-edge chips is admitting to skirting export restrictions.

- Most investors think we’ll need fewer chips, data centers, and AI infrastructure going forward. It’s the total opposite.

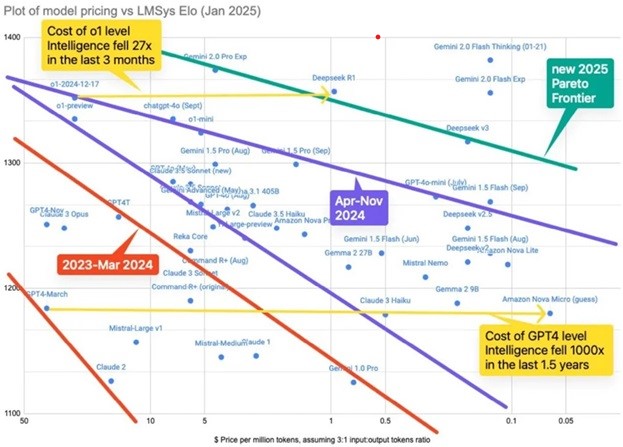

Did you know the cost to use a GPT-4-level model has collapsed 1,000X in the last 18 months?

.jpg.aspx;)

Source: @themacrosift on X

And yet, AI spending has exploded over this period.

Nvidia’s AI chip sales surged 600% when AI was getting dramatically cheaper. Why would DeepSeek’s efficiency gains be any different?

History shows us that each time a technology gets cheaper, it leads to more adoption and spending.

The cost of computing has plunged 99.99999998% since 1990. Did we use fewer chips and hard drives? No, we put computers in everything from toasters and car keys to kids’ toys. The same trend played out with cars, electricity, online streaming, and every other innovation I know of. It will also be true for AI.

Cheaper AI means more AI everywhere. More applications, more use cases, and more integration into daily life and business. Efficiency gains boost demand for AI infrastructure, not reduce it. The demand for “intelligence” is virtually unlimited.

Expect US AI firms to integrate DeepSeek’s efficiency gains into their models soon. Imagine how good AI will be when you take these breakthroughs and scale them up with 10X more compute.

DeepSeek’s tech impressed me. But at this early stage when AI is still rapidly improving, efficiency is overrated. The most important thing is creating better AI models. The path toward achieving that remains “more infrastructure.”

The big AI spenders won’t lift their foot off the gas anytime soon.

DeepSeek showed AI progress is nowhere near hitting a wall, as many feared a few months ago. AI is shifting gears and speeding up. For long-term investors and AI users, that’s very exciting.

- At RiskHedge, we’ve known about DeepSeek since last year when it released its first AI papers.

That means the largest AI spenders also knew about it.

A few days after DeepSeek news shocked the markets, Microsoft (MSFT) and Meta Platforms (META) both revealed huge AI spending increases.

Would they have made these announcements if they believed DeepSeek’s breakthrough would reduce demand? No way.

DeepSeek’s breakthrough isn’t a setback for AI progress; it’s an acceleration. More efficient AI will unleash a wave of innovation and adoption. And that’s great for AI infrastructure businesses.

In my Jolt investing letter, I write about AI and other breakthrough technological disruptions so you don’t fall behind. AI continues to be a major focus. If you’d like to join us and get the Jolt straight to your inbox every Monday and Friday, go here.

_______________

Stephen McBride is Chief Analyst, RiskHedge. To get more ideas like this sent straight to your inbox every Monday and Friday, make sure to sign up for The Jolt, a free investment letter focused on profiting from disruption.