Warren Buffett was three years old when his diehard Republican dad taught him to hate Democrats.

Little Warren didn’t get dessert unless he said something nasty about Roosevelt at the dinner table.

Buffett bought his first stock in 1942 and has invested under every president since. His success through all kinds of political climates led him to coin the famous line: “If you mix politics and investing, you’re making a big mistake.”

Here’s what history says about investing during elections…

I could fill the next five pages with data points about how stocks performed under different presidents. I’ve even read theories saying it’s best to buy stocks on October 1 of the second year of a presidential term and sell on December 31 of the fourth year.

I’ve done all the boring work for you. I’ve studied the data back as far as 1897, and one thing is crystal clear: There isn’t some golden, predictable pattern when it comes to presidents and the stock market.

Stocks have SOARED when both Republicans and Democrats were in power.

Stocks have TANKED when both Republicans and Democrats were in power.

We’re less than two months out from the most hyped election in US history.

Don’t listen to Wall Street analysts telling you about the Grand Canyon-sized differences between both sides and how each candidate will affect the stock market.

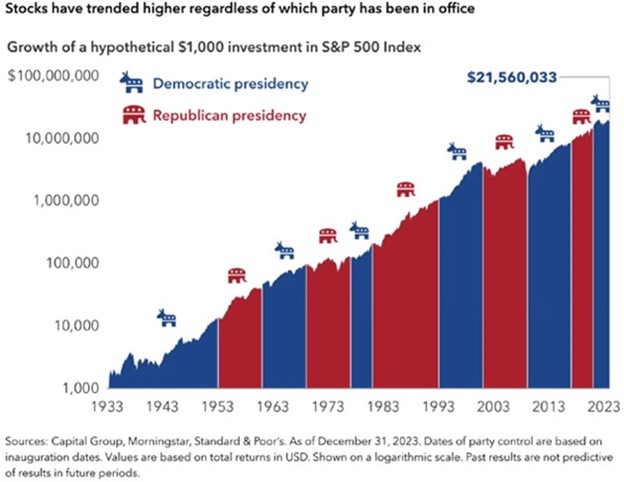

Instead, look at this chart:

Source: DataTrek

As you can see, stocks typically trend higher regardless of who controls the White House.

That’s not because markets “only go up.” It’s because American businesses are moneymaking machines, which drives stock prices higher.

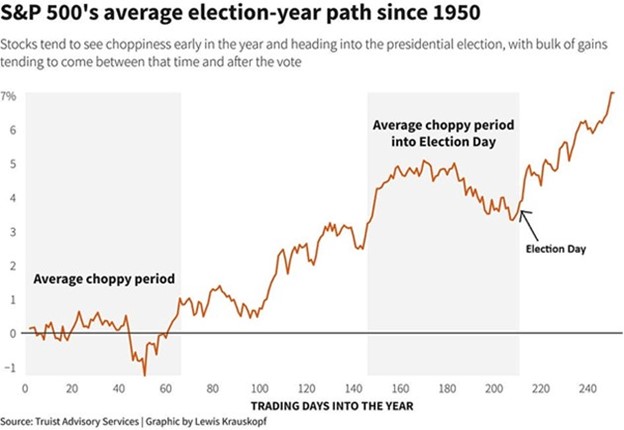

“I wouldn’t be surprised if stocks sell off heading into November’s political Super Bowl.”

That’s what I wrote back in January.

In election years, stocks usually peak around early September and then roll over as the “pre-game” jitters take hold. September and October are the worst months for stocks during presidential election years going back to 1950, as you can see:

Source: Reuters

At RiskHedge, our loose “script” is for stocks to experience a sharp pullback over the next 60 days, followed by a rally after the die is cast.

This mirrors some great research my friend and DataTrek Research founder Nick Colas shared recently.

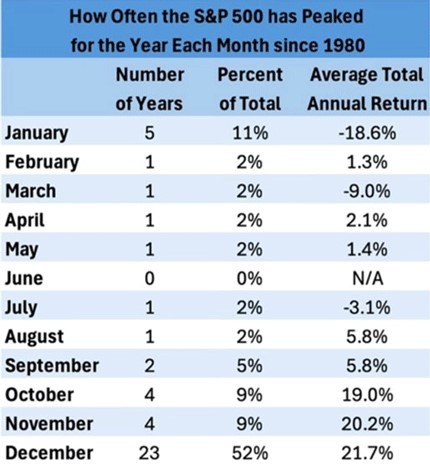

This table breaks down—by month—when the S&P 500 usually tops out for the year. As you can see, stocks have peaked in December 23 times over the past 44 years. Throw in January, and the S&P tops out around the holidays two-thirds of the time!

Source: @SethCL on X

In investing, it pays to think about what’s likely to happen rather than being certain about one outcome. It helps to account for uncertainty, which is always present in markets.

Markets may not follow my script, which is important information in itself. If stocks rip higher into the election (when they’re usually weak), that’ll tell us there’s a real bid behind this market. I’ll be watching closely.

Here’s what investors should do over the next two months:

Raise cash. If you have some stocks in your portfolio that you’ve soured on, consider selling them.

Use that dry powder to invest in great businesses profiting from disruptive megatrends behind them. I recommend dollar-cost averaging into these stocks over the next few months.

One of my top buys right now is Tesla (TSLA).

I like Tesla because it’s the most misunderstood stock on the market. Today, investors have their heads stuck in spreadsheets, calculating how much money Tesla makes on its cars. They’re missing the big opportunity: AI and robotics.

I believe AI will turn Tesla into a $10 trillion company before 2030. (It’s worth $700 million in 2024.)

In my free investing letter—The JOLT—I write about today’s biggest disruptive technologies and how to invest in them (every M/W/F). Go here to join today

_______________

Stephen McBride is Chief Analyst, RiskHedge. To get more ideas like this sent straight to your inbox every Monday, Wednesday and Friday, make sure to sign up for The Jolt, a free investment letter focused on profiting from disruption.

Expect smart insights and analysis on the latest breakthrough technologies, the big stories the mainstream media isn't reporting on, and much more... including actionable recommendations.

Click here to sign up.