US markets are having a good few weeks...

The S&P 500 is just inches away from reaching new all-time highs. It’s climbed 9% since August 5, while the tech-heavy Nasdaq jumped 12% over the same period.

But bullish as the indices look, I don’t want you to get too comfortable. Seasonal patterns indicate that we’re heading for some volatility.

The next two months have historically been tough on stocks.

Let me show you...

September is historically the worst month of the year for investors…

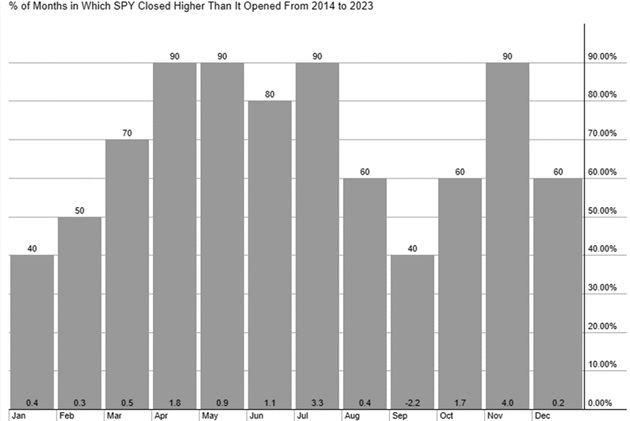

Take a look at this chart…

It shows the percentage of positive months for the S&P 500 (SPY) in the last 10 years and the average gain/loss:

Source: EquityClock

As you can see, September is by far the worst month of the year. The S&P 500 has fallen in 6 of the last 10 Septembers with an average drawdown of -2.2%.

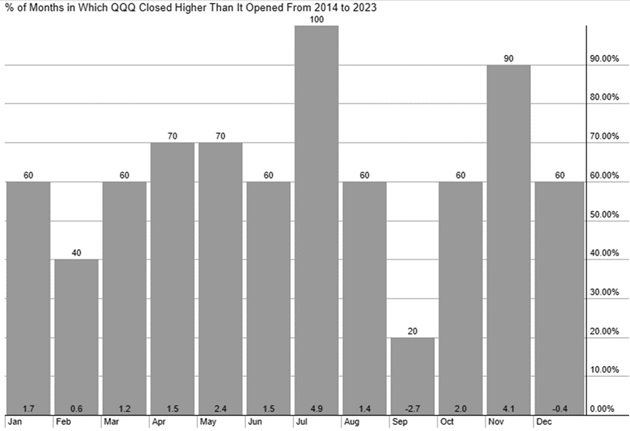

The Nasdaq (QQQ) follows a similar pattern, except that the performance is even worse:

Source: EquityClock

The Nasdaq fell in 8/10 of the last Septembers with an average drawdown of -2.7%.

Seasonal trends don’t favor stocks in October either…

Looking at the above averages, you might think October is a good month for stocks. The S&P 500 and Nasdaq were up in 6/10 of the last Octobers.

While that’s usually the case, this trend changes during election years, as I’ll show you in a moment.

I’ve been saying all year that the US presidential election is the biggest wild card of 2024. Back in January in my Disruption Investor advisory, I said, “This will be the most extraordinary US election ever, and not in a good way. Prepare to be depressed by the rhetoric, especially heading into November. This will likely weigh on the national psyche. Investors will go ‘risk-off.’ I wouldn’t be surprised if stocks sell off heading into November’s political Super Bowl.”

I still believe that.

In just the last few months, Biden dropped out, Trump survived an assassination attempt, Harris replaced Biden, and RFK Jr., a long-standing Democrat, suspended his campaign and announced he’s backing Trump. All this, and we still have two months until the end of elections!

The markets haven’t reacted much to election-related events so far. But this could change as we get closer to November 5 and the race and rhetoric intensify.

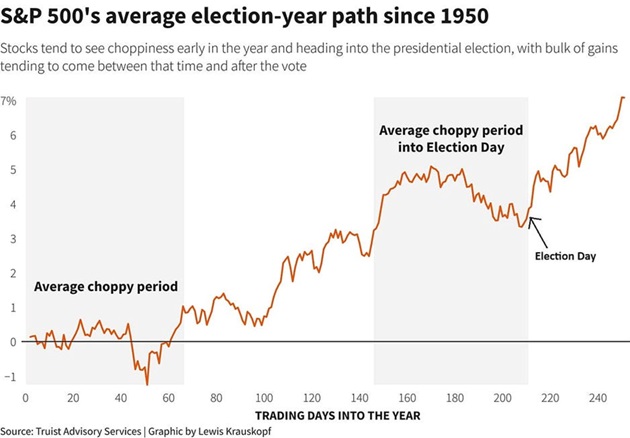

Historically, stocks experience a sharp pullback in October in election years… followed by a rally after the die is cast. Take a look at this chart dating back to 1950:

Today, we’re 170 trading days into the year, right around the time stocks typically start sliding down.

Of course, these are just averages. Anything can happen in a given year. But this chart paired with the first one I showed you tells me now is no time to get aggressive.

Instead, you should use any election-related volatility to “scale in” (dollar-cost average) into world-class stocks profiting from megatrends.

Market sell-offs can be scary.

You must have a plan before the storm hits. Otherwise, you’ll likely panic and make wrong moves that cost you money.

Here’s my game plan if markets get a little rocky over the coming weeks: Buy world-class stocks when they go on sale using the dollar-cost averaging approach. With this technique, you place a fixed dollar amount into an investment on a regular basis.

Say you plan to invest $10,000 in one stock. Instead of buying $10,000 in one go, you could split it into four chunks of $2,500 over four months.

Peter Lynch is on my Mount Rushmore of investors.

If you don’t know Lynch, he ran Fidelity’s flagship investment fund. In 13 years, he grew the fund from $20 million to $14 billion! Those are off-the-charts returns.

My all-time favorite Peter Lynch quote is: “Behind every stock, there is a company.”

Stock prices are schizophrenic. One day they’re up, next day they’re down.

But remember: When you buy a stock, you own a piece of a company. While stock prices move up and down like a Las Vegas slot machine, companies don’t change nearly as much.

That’s especially true for great disruptive businesses in long-term megatrends that thrive no matter what the broader market is doing.

Use any volatility from now until the elections to buy world-class stocks at discounts. I expect stocks to rally and reach new all-time highs into year end. As far as where to start, I'm still focused on artificial intelligence (AI). Right now Nvidia's got all the attention, but there are many are many lesser-known companies set to capture unfathomable amounts of money being poured into the AI infrastructure buildout.

In my free M/W/F investing letter, The Jolt, I share my insights on the markets and write about disruptive technologies like AI and biotech and how to invest in them. You can join here if you’re interested.

_______________

Stephen McBride is Chief Analyst, RiskHedge. To get more ideas like this sent straight to your inbox every Monday, Wednesday and Friday, make sure to sign up for The Jolt, a free investment letter focused on profiting from disruption.

Expect smart insights and analysis on the latest breakthrough technologies, the big stories the mainstream media isn't reporting on, and much more... including actionable recommendations.

Click here to sign up.