Emerging market equity funds are leading the global performance this year, bolstered by attractive valuations, years of under-positioning by investors and an easing of economic pressures after U.S. President Donald Trump's pause on tariffs.

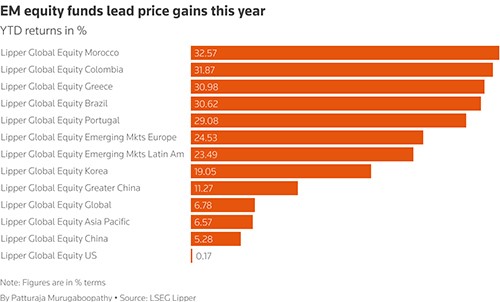

According to data compiled by LSEG, funds tracking equities in Latin America and emerging Europe have each gained around 24% so far this year, while broader emerging market equity funds are up 9.3% (see chart, below).

Notably, equity funds focused on Morocco, Colombia, Greece, Brazil, and Portugal have each returned more than 30% this year. In comparison, U.S.-focused equity funds have returned just 0.17%, and global equity funds are up 6.8%.

The outperformance of emerging markets marks a reversal after their years of lagging developed markets, during which U.S. equities, driven by the AI-led tech rally, delivered stellar index gains.

Urgent: New Global ‘Anti-Dollar’ Payment System Takes Effect... See Here

This year, however, investors have been selling U.S. assets as worries over possible recession, fiscal instability and Trump's erratic policies shake their faith in the dollar.

LSEG Lipper data showed dedicated EM equity funds have attracted $10.6 billion in inflows in the first five months of the year, a 43% increase over the same period last year.

Malcolm Dorson, emerging markets senior portfolio manager at GlobalX, attributed this to how under-owned emerging market equities are. U.S. investors allocate just 3%–5% to emerging markets, well below the 10.5% weighting in the MSCI Global Index and far short of their roughly 25% share of global market capitalisation, he said.

"Allocators are dangerously short a deeply discounted and fast-growing asset class," he said.

Analysts also highlight improving fundamentals. Latin American countries are largely insulated from tariffs, given their trade deficits with the U.S., while Asian economies are pivoting toward domestic consumption.

Further, J.P.Morgan upgraded its rating on emerging market stocks to "overweight" from "neutral" earlier this week. It said it expects all central banks across developing economies, excluding Brazil, to ease monetary policy, which could increase economic activity and the attractiveness of equity markets.

Gains in tech stocks have buoyed Chinese and Hong Kong equities, drawing renewed interest from foreign investors seeking to invest in artificial intelligence and other low-cost tech firms such as DeepSeek.

There are opportunities in Mexico and Brazil, which have remained resilient despite trade tensions, according to Alison Shimada, portfolio manager at Allspring Global Investments.

"The China consumer story is especially interesting right now," she said. "Beijing is very focused on stimulating the consumer economy. India may be overbought, but there are pockets of opportunity such as power companies and non-bank financials."

Alert: U.S. Dollar Ousted, Global Powers Are Turning Against America... See Why Here

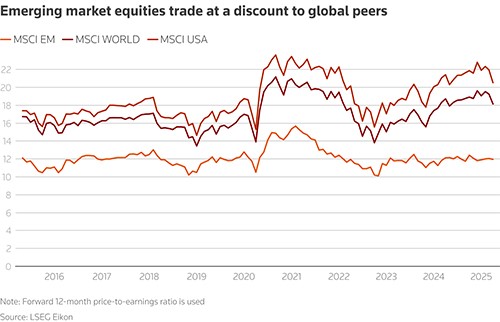

At the end of last month, the MSCI Emerging Markets Index was trading at a forward 12-month price-to-earnings ratio (P/E) of 11.96, just below its 10-year average of 12.1.

In contrast, the MSCI USA and MSCI World indexes were trading at 20.5 and 18.1, well above their 10-year averages of 18.8 and 16.9, respectively (see chart, below).