With a first Federal Reserve interest rate cut of 2025 now considered to be in the bag, world markets are hungry for signals on how much more comes after. This has allowed the dollar to stabilize at four-year lows against the euro ahead of today's decision.

U.S. stocks also stalled on Tuesday and futures were flat ahead of today's bell, with Fed rate cut bets now gravitating to exactly 25 basis points after news of roaring 5% annual retail sales growth in August helped put the kibosh on thoughts of a bigger move this week.

Gold backed off, too. That didn't stop U.S. long bonds rallying further, however. Helped by brisk demand for 20-year debt at Tuesday's auction, the 30-year yield hit a 4-1/2 month low of 4.62% ahead of the Fed announcement.

Hong Kong shares closed at their highest level in four years, as the expected Fed cut, weakening dollar and buoyant local technology stocks all helped. Amid signs of returning foreign funds, confidence in China's artificial intelligence capabilities is rising and U.S. President Donald Trump's announcement of a deal to keep TikTok operating in America lifted appetite for risk assets.

The U.S. and Chinese presidents are due to speak on Friday.

By contrast, Nvidia slipped on Tuesday and continued to fall another 1% overnight on reports of weak China demand for a new AI chip and after the Financial Times reported that China's main regulator told the country's big tech firms to stop buying all of Nvidia's AI chips.

The euro surged to a four-year high against a weakening dollar on Tuesday, but the greenback stabilized somewhat today and the dollar index bounced slightly from two-month lows.

However, China's offshore yuan continues to boom to its strongest level of the year — and the best since the U.S. election. Japan's yen was at its strongest in a month ahead of Friday's Bank of Japan decision and the Canadian dollar steadied ahead of Wednesday's expected quarter point rate cut by the Bank of Canada. Soft Canadian August inflation data on Tuesday underscored BOC easing bets. The Aussie dollar fell back from Tuesday's one-year high.

With Trump visiting Britain and the Bank of England's policy decision tomorrow, sterling hovered close to two-month highs against the ailing dollar and UK stocks and gilt prices were firmer.

As part of the state visit, Britain and the United States agreed a technology pact to boost ties in AI, quantum computing and civil nuclear energy — and top U.S. firms led by Microsoft pledged 31 billion pounds ($42 billion) in UK investments. BoE easing bets for the rest of this year are off as UK inflation in August held at 3.8% as expected — the highest inflation among major advanced economies.

TODAY'S MARKET MINUTE

President Donald Trump on Tuesday announced an agreement between the U.S. and China to keep TikTok operating in the United States, with three sources familiar with the matter saying the deal was similar to one discussed earlier this year.

Britain and the United States have agreed a technology pact to boost ties in AI, quantum computing and civil nuclear energy. The "Tech Prosperity Deal" is part of U.S. President Donald Trump's second state visit to Britain, which formally begins on Wednesday.

President Donald Trump's renewed push to nix quarterly corporate disclosures, a drive that went nowhere in his first administration, has a better chance this time as the White House takes more control of the Securities and Exchange Commission's agenda.

The Trump administration has made it clear that they think Chair Jay Powell’s team has done a poor job with inflation control. Eurizon SLJ asset management CEO Stephen Jen argues that the president may have a point.

The rush to hedge U.S. equity exposure this year was initially seen as part of a broad 'de-dollarization' process. But, writes ROI markets columnist Jamie McGeever, as the months go by and U.S. stocks roar to fresh tech-fueled highs, this theory seems to be crumbling.

CHART OF THE DAY

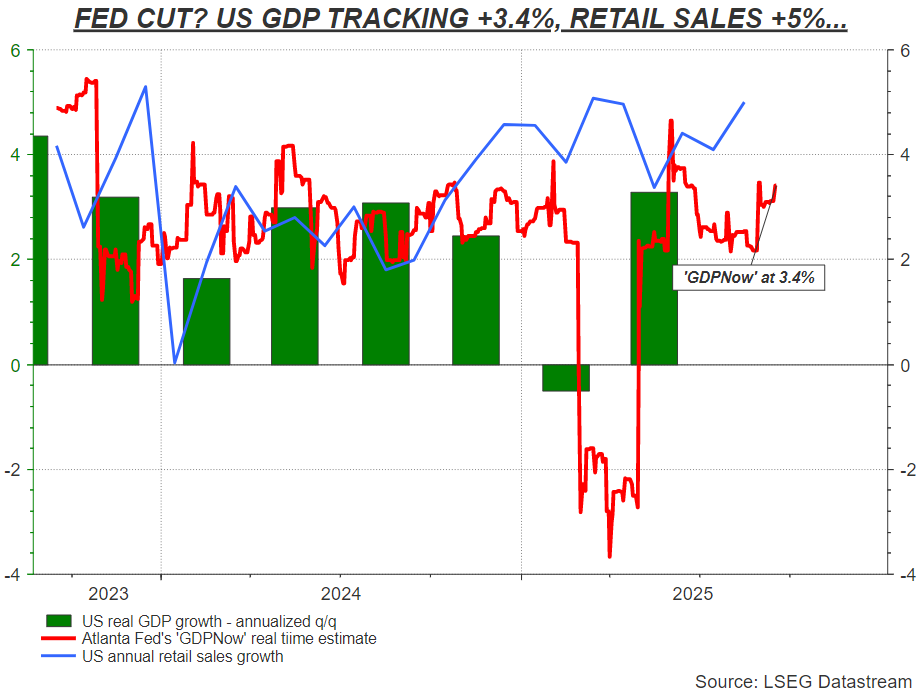

There may be many reasons why the Fed decides to resume policy easing with its first interest rate cut of the year on Wednesday — but the current pace of GDP growth, booming retail sales, the loosest financial conditions in more than three years and inflation still far above target are not among them.

TODAY'S EVENTS TO WATCH

* U.S. August housing starts/permits (8:30 AM EDT)

* Bank of Canada policy decision (9:45 AM EDT) and press conference (10:30 AM EDT)

* U.S. Federal Reserve's policy decision and updated economic and rate projections (2:00 PM EDT), press conference (2:30 PM EDT)

* European Central Bank President Christine Lagarde speaks

* U.S. President Donald Trump visits Britain

* U.S. corporate earnings: General Mills, Progressive