U.S. economic activity has declined and higher tariff rates have put upward pressure on costs and prices in the weeks since Federal Reserve policymakers last met to set interest rates, the U.S. central bank said Wednesday in its latest snapshot of the nation's economy.

"On balance, the outlook remains slightly pessimistic and uncertain, unchanged relative to the previous report," according to the document, known as the "Beige Book" and which is based on surveys, interviews and observations collected from the commercial and community contacts of each of the Fed's 12 regional banks through May 23.

"There were widespread reports of contacts expecting costs and prices to rise at a faster rate going forward." The Fed has kept its policy rate in the current 4.25%-4.50% range since December and is widely expected to leave it there for another few months while its policymakers gauge the impact of U.S. President Donald Trump's trade and other policies on inflation and the labor market.

Analysts and Fed policymakers alike say they anticipate both the inflation and the labor market data to deteriorate, and the Beige Book suggests it is already happening, if still unevenly.

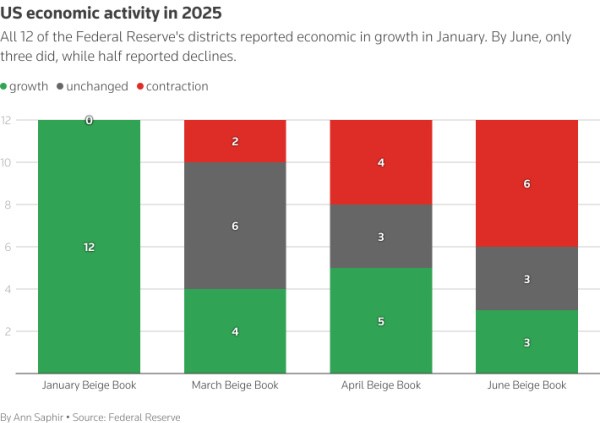

In January, all 12 Fed districts reported economic growth; the latest report showed just three did, while half reported economic declines.

Contacts generally expected so-far moderate price increases to accelerate, with a few describing the expected cost increases as "strong, significant, or substantial."

"A number of businesses reported they were no longer stocking goods whose higher prices were becoming infeasible," the New York Fed reported, adding that one florist said it was "adjusting flower varieties based on rapidly changing costs by source country." The New York Fed was one of the regions where economic activity declined modestly.

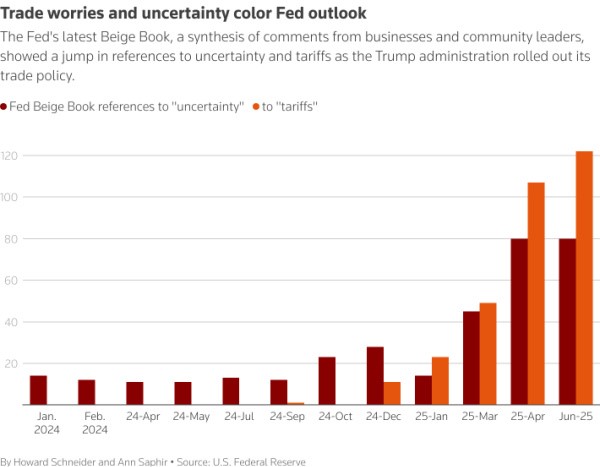

Tariffs remained a rising concern, along with uncertainty, impacting in particular prices but also expectations for growth.

"In some cases, firms explicitly included a separate tariff line for items or contingencies in their price quotes and contracts," said the San Francisco Fed, where economic activity was reported to have slowed. "One contact observed that price increases that had been implemented in anticipation of certain tariffs were not rolled back once those tariffs were removed."

The Cleveland Fed reported consumer spending had flattened out, with contacts saying it was hard to forecast demand because of trade policy uncertainty. "Many auto dealers reported an increase in purchases ahead of planned tariffs, and one dealership expected tariff-related sticker shock to hit customer demand starting in early June," the Cleveland Fed wrote, adding:

"Retailers reported a general pullback in consumer discretionary spending, although one retailer benefited from customers who traded down from larger discretionary purchases to more modest ones."

To the Boston Fed, the outlook was characterized "by a mix of cautious optimism and blunt pessimism," with optimists focused on "the possibility that resolution of uncertainty could unlock economic activity moving forward; the more pessimistic contacts, in contrast, emphasized the potential negative impacts on demand from tariffs and other federal policies."

Meanwhile most districts reported employment as "flat," but impacts appeared to vary by industry, and location.

As Richmond Fed reported, "a Maryland construction company planned on increasing employment due to available work and a fast-casual restaurant decided to move ahead with adding locations, thus increasing employment. Conversely, a different fast-casual restaurant located in the DC-region paused all hiring due to local economic uncertainty."

NATIONAL DATA

The Beige Book offers a counterpoint to the national hard economic data, which Fed policymakers say show a solid labor market and continued improvement in inflation.

The Personal Consumption Expenditures Price Index rose just 2.1% in April from a year earlier, the lowest reading in four years and just a hair above the Fed's 2% inflation target.

Economists expect data due on Friday to show U.S. employers added 130,000 jobs last month, down from 177,000 in April but still above the 100,000 or so thought to be adequate for a healthy labor market.

But Fed officials say they are putting a premium on more timely data, including the day-to-day experiences of businesses and households like those captured in the Beige Book.

Other survey-based data show that deterioration as well, including an Institute for Supply Management report earlier on Wednesday that showed the service sector contracted in May for the first time in a year, and businesses paid more for inputs.

The specter of slowing growth and accelerating inflation poses a particular dilemma for the Fed, which can only fight one of those problems at a time.