A pivotal week for big central bank decisions started quietly for world markets, with the U.S. Federal Reserve expected to deliver its first rate cut of the year and the only debate seemingly about whether it's a quarter point or 50 basis points.

With the U.S. labor market softening, even as consumer price inflation remains sticky, the main question for investors is whether embattled Fed Chair Jerome Powell signals that Wednesday's cut is the start of a broader easing cycle.

Futures have about 70 bps of Fed cuts priced over the three meetings to year-end, and stock futures are flat to firmer ahead of Monday's bell.

A Senate vote on President Donald Trump's latest Fed board nominee — White House adviser Stephen Miran — is due on Monday.

Along with the Fed, the Bank of Canada is also expected to trim rates this week —but the Bank of England and Bank of Japan are likely to hold steady.

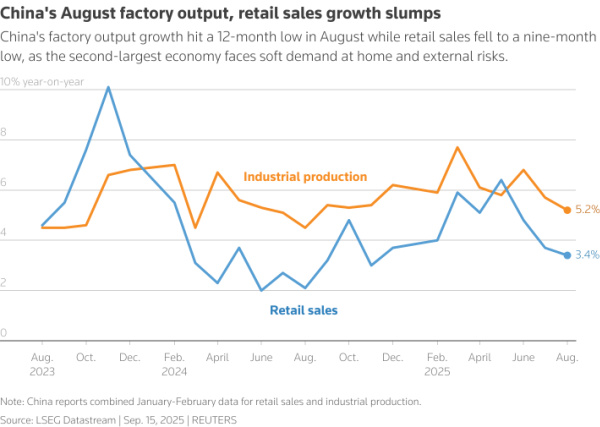

A wave of weak Chinese economic numbers for this month showed ebbing retail and industrial growth but merely reinforced expectations for more fiscal stimulus and markets were steady to firmer.

The dollar was a touch lower as the week kicked off, with an eye on U.S. retail and industrial updates tomorrow and even as longer-term Treasury yields nudged higher.

Geopolitical and economic risks added to the mix. Fitch's expected downgrade of France's sovereign credit rating to A+ late on Friday underscored the fiscal strains in the euro zone's second-largest economy and the task facing its new Prime Minister Sebastien Lecornu. But markets shrugged it off as Fitch's outlook switched to stable and the agency also raised Portugal's rating, while S&P Global upped Spain's.

Ukrainian drone strikes on Russian oil infrastructure pushed crude higher, meanwhile.

MSCI’s Asia-Pacific ex-Japan index hovered near four-year highs, while South Korea's Kospi hit another record after scrapping a planned tax hike on stock investments. U.S.-China trade talks resumed in Madrid as Washington presses allies to impose tariffs over Beijing’s Russian oil purchases, and U.S. Treasury Secretary Scott Bessent said both sides are close to reaching an agreement on social media platform TikTok.

TODAY'S MARKET MINUTE

U.S. Democrats have asked the Trump administration to press China to curb "structural overproduction," essentially overhauling Beijing's economic model.

Delegations from the U.S. and China were set to continue their talks in Madrid into a second day on Monday over trade tensions and an imminent deadline for Chinese divestment from the short-video app TikTok.

The United States and Britain will announce agreements on technology and civil nuclear energy during U.S. President Donald Trump's unprecedented second state visit this week, as the UK hopes to finalize steel tariffs under a much-vaunted trade deal.

BP's recent discovery of a giant oilfield has reignited investor enthusiasm, suggesting that fears of ‘stranded assets’ may have receded, writes ROI energy columnist Ron Bousso.

China's surplus crude surged to just over 1 million barrels per day in August as robust imports and domestic production trumped an increase in refinery processing. Read the latest on China’s crude oil stockpiles from ROI columnist Clyde Russell.

CHART OF THE DAY

China's factory output and retail sales reported their weakest growth since last year in August, keeping pressure on Beijing to roll out more stimulus to buoy the world's second-largest economy just as the latest U.S. and Chinese trade negotiations in Madrid entered a second day.

The disappointing data split economists over whether policymakers would need more near-term fiscal support to hit their annual growth target of "around 5%," with manufacturers awaiting more clarity on a U.S. trade deal and domestic demand curbed by a wobbly job market and property crisis. Weather has also not helped, with manufacturing activity affected by the hottest conditions since 1961 and the longest rainy season for the same period.

TODAY'S EVENTS TO WATCH

* New York Fed's September "Empire State" manufacturing survey (8:30 AM EDT)

* U.S. Senate votes to confirm President Trump's Fed board nominee Stephen Miran

* European Central Bank President Christine Lagarde and ECB board member Isabel Schnabel both speak

* European Council President Antonio Costa visits Cyprus ahead of the island assuming the rotating EU presidency in 2026