Hopes for a U.S.-Europe trade deal and signs of rebounding world business confidence are driving world stocks to new highs this morning, with Tesla one of the few losers after another earnings day flub.

KEY MARKET EVENTS

* Early in the day, all eyes will be on the European Central Bank as it announces its latest policy decision.

* Reports of a Brussels-Washington trade deal that will halve threatened U.S. tariffs to 15% is likely to embolden the ECB to stand pat on rates even as the euro strengthens back toward $1.18 for the first time in three weeks.

* U.S. trade deal reports drove European stocks up almost 1% to 6-week highs, with quarterly results from Deutsche Bank and BNP Paribas lifting both those stocks even as chipmaker STMicro STMPA.PA slumped 10.5% on its earnings.

* Wall Street earnings updates reflected diverging fortunes within the Magnificent Seven. Tesla's stock fell by another 7% ahead of today's bell on its dour outlook, while Alphabet shares pushed higher on its cloud boost and higher AI spend.

Intel and Dow are among the firms reporting later. U.S. July business confidence readings are due out later following Europe's equivalent, which showed an above-forecast private sector expansion this month.

* China's yuan was one of the big movers early on Thursday, surging to its strongest level this year as China's central bank guided the currency higher and worldwide trade hopes fed expectations of a detente between Washington and Beijing. U.S.

Treasury Secretary Bessent said China trade talks were in a "good place" just as Chinese leaders met with European Union counterparts in Beijing. Today's column takes a look at U.S. financial conditions, which – despite what White House pressure might suggest – are actually the loosest they’ve been since 2021 by some measures.

TODAY'S MARKET MINUTE

* U.S. President Donald Trump, a robust critic of Federal Reserve Chair Jerome Powell, will visit the central bank on Thursday, the White House said, a surprise move that escalates tension between the administration and the Fed.

* Tesla Chief Executive Elon Musk said on Wednesday that U.S. government cuts in support for electric vehicle makers could lead to a "few rough quarters" for the company before a wave of revenue from self-driving software and services begins late next year.

* Chinese President Xi Jinping urged top European Union officials on Thursday to "properly handle differences and frictions" as he criticized Brussels's recent trade actions against Beijing at a tense summit dominated by concerns on trade and the Ukraine war.

* Exxon Mobil and Chevron's recent major acquisitions raise a provocative question: does the U.S. still need two energy titans, or might it be more efficient for the two to join forces? Read the latest from ROI energy columnist Ron Bousso.

* Surging investment into Hong Kong by mainland Chinese investors is increasing market liquidity and depth. Short-term headwinds could slow this capital flood, but Emmer Capital Partners Ltd. CEO Manishi Raychaudhuri writes that market innovation and the push for diversification are likely to propel this trend over time.

CHART OF THE DAY

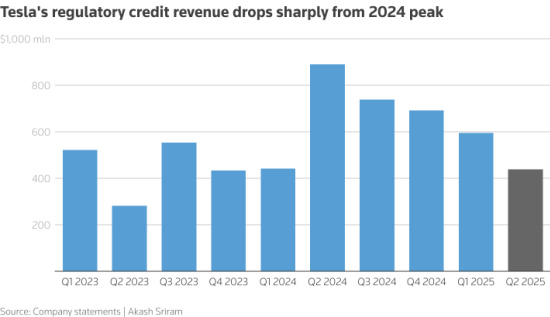

Tesla shares sank nearly 7% in premarket trading on Thursday as the EV giant grapples with sinking sales and mounting doubts over its future under CEO Elon Musk, deepening investor anxiety after another shaky quarter.

Musk warned of a "few rough quarters" ahead for Tesla, as cuts in the Trump administration's EV incentives compound its challenges. The automaker reported one of its most difficult quarters in over a decade, marked by a second consecutive revenue slide.

TODAY'S EVENTS TO WATCH

* European Central Bank policy decision (8:15 AM EDT) and press conference by ECB President Christine Lagarde (8:45 AM EDT)

* U.S. weekly jobless claims (8:30 AM EDT), Chicago Federal Reserve June national activity index (8:30 AM EDT), Flash July U.S. business surveys from S&PGlobal (9:45 AM EDT), June new home sales (10:00 AM EDT), Kansas City Fed July business surveys (11:00 AM EDT)

* U.S. corporate earnings: Intel, Dow, Honeywell, Allegion, Newmont, CenterPoint, Ameriprise, Nasdaq, Mohawk, Keurig Dr Pepper, Westinghouse, Union Pacific, Valero, Dover, Textron, West Pharmaceutical, VeriSign, Southwest Airlines, Weyerhaeuser, AO Smith, L3Harris, Labcorp, Deckers Outdoor, LKQ, Pool

* U.S. Treasury sells $21 billion of 10-year inflation-protected securities

* European Commission President Ursula von der Leyen and European Council President Antonio Costa meet Chinese President Xi Jinping and Chinese Premier Li Qiang in Beijing.