All eyes remain focused on Washington, with Senate Republicans still locked in a marathon session, known as "vote-a-rama," as they try to pass a contentious tax cut and spending bill that could add trillions of dollars to the country’s already high debt load.

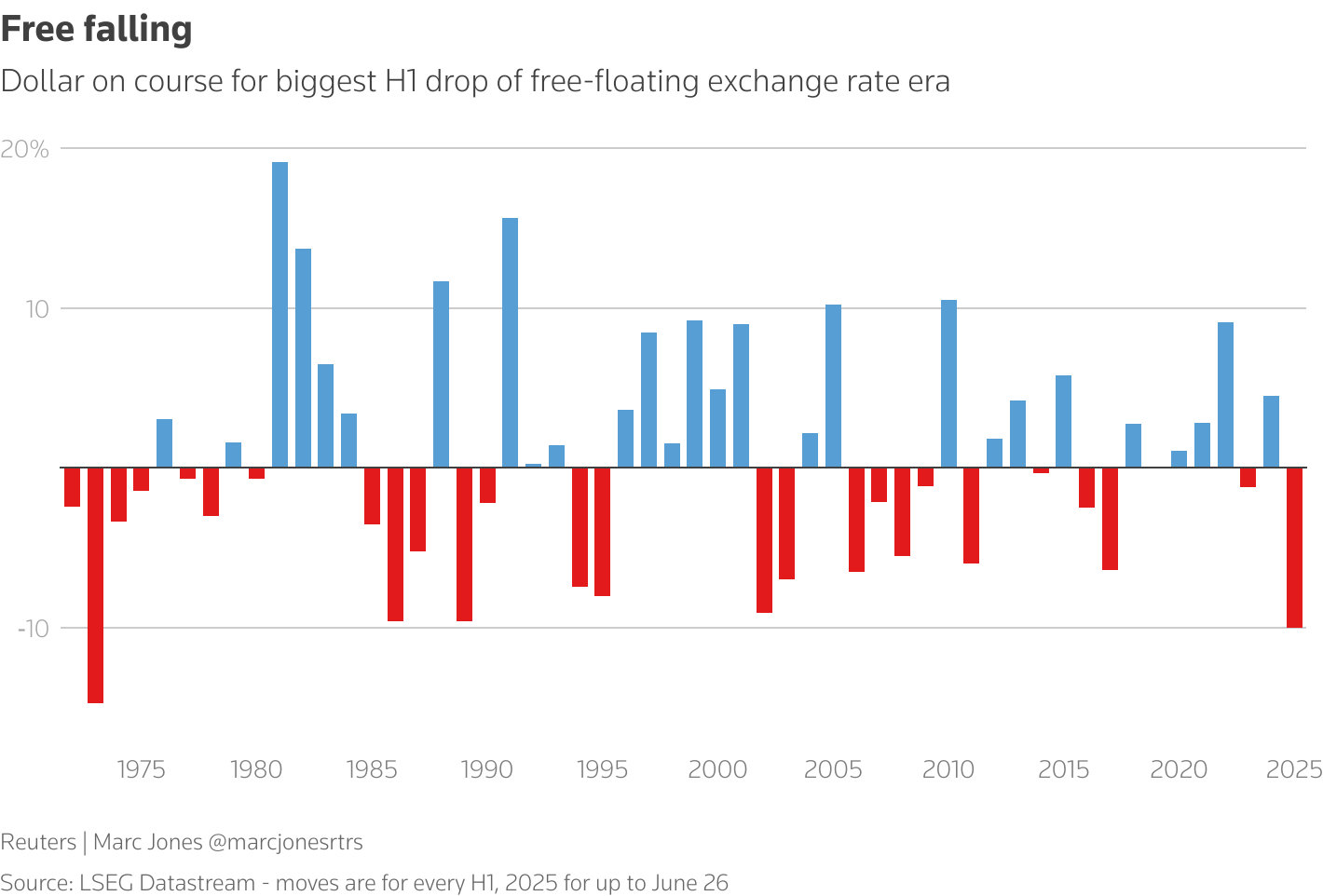

This hasn’t helped the dollar, which is languishing at its lowest levels against the euro in almost four years, as the fiscal bill keeps debt worries front and center for global investors.

Mike Dolan is enjoying some well-deserved time off over the next two weeks, but the Reuters markets team is here to provide you with all the information you need to start your day.

TODAY'S MARKET MINUTE

* U.S. Senate Republicans were still trying to pass President Donald Trump's sweeping tax-cut and spending bill early on Tuesday morning, despite divisions within the party about its expected $3.3 trillion hit to the nation's debt pile.

* President Trump suggested on Tuesday that the government efficiency department should take a look at the subsidies that Tesla (TSLA.O), opens new tab CEO Elon Musk's companies have received in order to save money.

* President Trump expressed frustration with U.S.-Japan trade negotiations on Monday as Treasury Secretary Scott Bessent warned that countries could be notified of sharply higher tariffs as a July 9 deadline approaches despite good-faith negotiations.

* There has been much discussion of the so-called "Trump put" for equities, but perhaps more attention should be paid to the administration's effective "Treasury Put," claims Stephen Jen, CEO and co-CIO of Eurizon SLJ asset management.

* U.S. power sector emissions are already at their highest levels in three years, writes ROI columnist Gavin Maguire, but they are likely to climb even higher in the coming months.

VOTE-A-RAMA MARCHES ON

Senators are voting in a marathon session featuring a series of amendments by Republicans and the minority Democrats, part of the arcane process Republicans are using to bypass Senate rules that normally require 60 of the chamber's 100 members to agree on legislation.

It is unclear how long the voting, which started on Monday, will last.

What's interesting is how financial markets are reacting to developments on the Hill.

As mentioned above, the latest signs of U.S. policy uncertainty and concern about ever-rising deficits are weighing on the dollar.

Now look at bond markets, which have been notably quiet in the face of fiscal worries.

The nonpartisan Congressional Budget Office released its assessment on Sunday of the bill's hit to the $36.2 trillion U.S. debt pile. The Senate version is estimated to cost $3.3 trillion, $800 billion more than the version passed last month in the House of Representatives. So, where have the so-called bond vigilantes gone?

One explanation is that attention, for now, has returned to inflation and growing expectations that Federal Reserve interest rate cuts will come sooner rather than later. And on that point, U.S. President Donald Trump on Monday continued to pressure Fed chief Jerome Powell to cut rates. Goldman Sachs reckons the Fed will deliver three rate cuts this year.

With markets pricing in roughly two quarter-point rate cuts by year-end, bond investors, it appears, are happy with U.S. 10-year yields at around 4.2% — the lowest in around two months.

The other point for bond markets, with regards to the bill, is that even if it is passed by Trump's July 4 deadline, a debt ceiling increase in the bill does not become an issue until later in the summer.

Generally upbeat sentiment in stock markets meanwhile — note the S&P 500 and Nasdaq hit record closing highs on Monday — could be put to the test by signs that efforts to secure trade deals may be stalling. Trump expressed frustration with U.S.-Japan trade negotiations on Monday, as Treasury Secretary Scott Bessent warned that countries could be notified of sharply higher tariffs as a July 9 deadline approaches despite good-faith negotiations.

CHART OF THE DAY

The U.S. dollar index, which measures its value against a basket of other major currencies, is down almost 11% so far this year. In fact, the dollar has suffered its biggest first-half dive since the early 1970s. While the currency is expected to remain the world's No.1. reserve currency for some time to come given the size of the U.S. economy and the unrivaled depth of its capital markets, sentiment towards the dollar has taken a hit this year against a backdrop of concern about erratic U.S. policy making, trade tensions and worries about Fed independence.

TODAY'S EVENTS TO WATCH

* ISM June data

* JOLTS May job openings

* Federal Reserve Chair Jerome Powell speaks at ECB forum

* Constellation Brands earnings results