Wall Street brokerages retained their expectations for a September rate cut following a soft jobs report. Data on Friday showed nonfarm payrolls increased by 73,000 jobs last month after rising by a downwardly revised 14,000 in June.

Economists polled by Reuters forecast payrolls advancing by 110,000 jobs in July. Macquarie changed its rate-cut call following the jobs data and expects the Fed to deliver its next interest rate cut in September as compared to their previous forecast of a 25-basis-point reduction in December.

Last month, the U.S. central bank held interest rates steady and maintained its projection for two cuts this year, though a growing minority sees no cuts at all, and slightly dialed back its outlook to just one 25-basis-point cut in both 2026 and 2027.

Traders are pricing in 58.5 bps in rate cuts by year-end, according to data compiled by LSEG. They are penciling in about a 77.7% chance of a 25-bps cut in September, according to the CME Group's FedWatch tool.

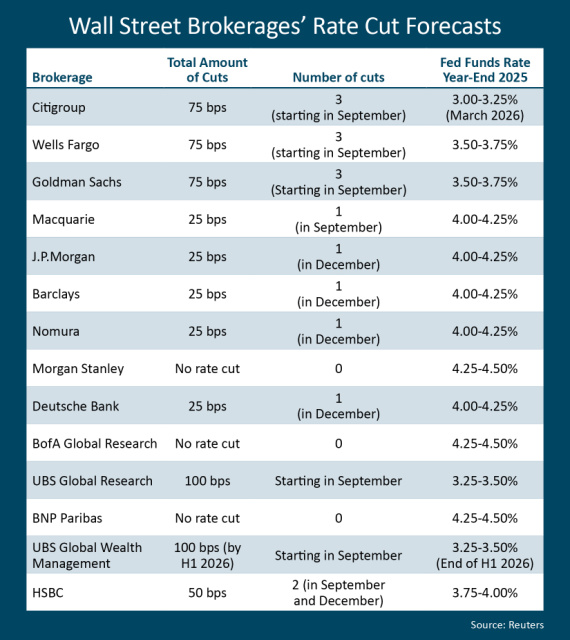

Here are the forecasts from major brokerages for 2025: