Major brokerages, including Goldman Sachs, J.P.Morgan and Morgan Stanley, have forecast slower global growth for late 2025 due to economic uncertainty fueled by tariffs and geopolitical tensions.

The U.S. economy is expected to grow between 1% and 2% this year, according to estimates from leading brokerages, as tariffs push prices higher, while softening labor markets help avoid a potential wage-price spiral.

But U.S. equities have risen over 30% since hitting their lows in April following President Donald Trump's "Liberation Day" tariffs.

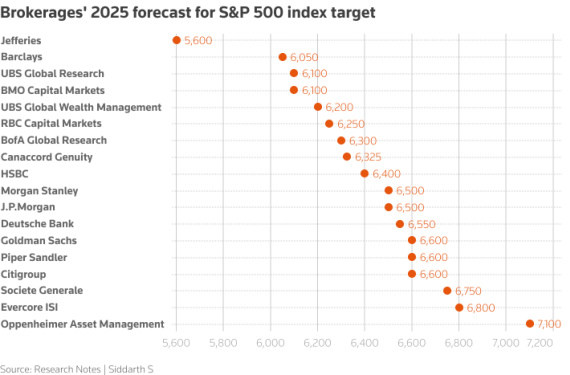

Citigroup and UBS Global Research became the latest Wall Street brokerages to raise their year-end targets for the S&P 500 index, pointing to receding policy risks and resilient corporate earnings. Oppenheimer Asset Management sees the index climbing as high as 7,100, the highest on Wall Street, while Jefferies is the only brokerage to set a target lower than 6,000 at 5,600.

Meanwhile, central banks, especially the U.S. Federal Reserve, are on pause, waiting to see how the situation plays out. Following are the forecasts from some top banks on economic growth, and the performance of major asset classes in 2025.