Uncertainties around U.S. policies may slow global economic growth modestly in 2025, according to major brokerages.

They expect U.S. President-elect Donald Trump's proposed tariffs to fuel volatility across global markets, spurring inflationary pressures and, in turn, limiting the scope for major central banks to ease monetary policy.

World economies and equity markets have had a robust year, with global growth expected to average 3.1% this year, a Reuters poll published in October showed.

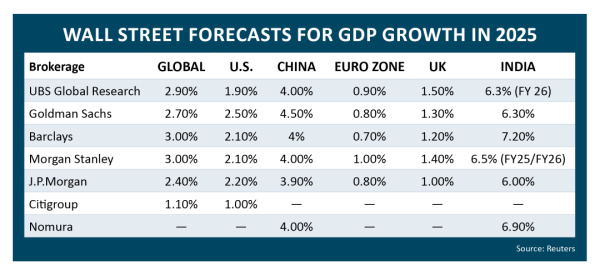

Major brokerages forecast U.S. gross domestic product growth of between 1% and 2.5% in 2025, with the average coming in at 1.97% (see chart below).

As for U.S. stocks, Goldman Sachs and Morgan Stanley both have a 2025 year-end target of 6,500 for the S&P 500. UBS Global Research is predicting the S&P 500 benchmark index will reach 6,400 by the end of 2025.

Goldman Sachs, J.P. Morgan, Morgan Stanley and Barclays each foresee inflation remaining high year over year in 2025, with predictions of headline consumer price index (CPI) at 2.5%, 2.4%, 2.3% and 2.3%, respectively