Sorry. There is a fine line between reality and hopeful wishing.

First of all, I do not see an end of the war in Ukraine, with its associated negatvie impacts on global commerce.

This scenario also puts a burden on the U.S. Treasury: already printing enough money to keep up with the government’s spending.

A just passed a $1.65 trillion "omnibus" spending bill made it through Congress.

Republicans failed to block passage of this legislation. This is in spite of their slim majority in the U.S. House. I wonder, how much of this money will find its way into the consumer side of the inflation equation.

Whatever the money is spent for, it certainly will add to the 31 trillion dollars of our national debt, which already is 30% above our gross national product (GDP).

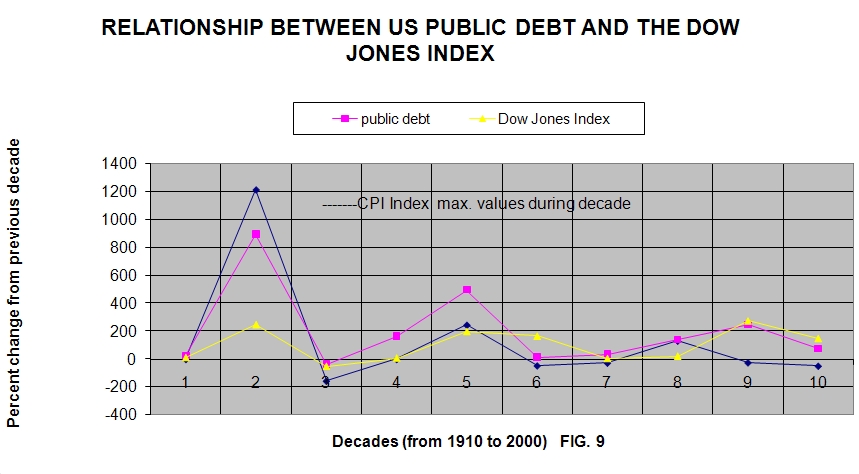

History has shown that the Federal debt and the CPI (Consumer Price Index) proceed in "lockstep."

The difference between the rate of debt increase, and the rate of inflation, never varied by more than 10%.

The good news is, that during the same period, the Dow Jones Industrials similarly marched in-step with inflation.

During this writer's lifetime, he saw two major currency devaluations.

Many were financially adversely impacted, except — shareholders.

Here is an example of how the above relationship between value of stocks and inflation works out. In 1960, this writer was able to buy one gallon of gas for a $ 1.25.

At the same time, the Dow stood at 5000. Now, 60 years later, our average gas price floats around $ 3.90, while the Dow industrial Index crept up to 33,000.

We now had a price increase of 3.12 times, while during the same period, the Dow increased six times.

.jpg.aspx;?height=500&width=600) (Above graph: Courtesy of Dr. Hans D. Baumann)

(Above graph: Courtesy of Dr. Hans D. Baumann)

Here is another example, I remember in 1960.

I was buying a share of Chevron for $ 12.50 (now the same stock sells for $ 172.-) an increase of 13.4 times; certainly way above the inflation rate, even disregarding the oil price fluctuations. (Editor's note: For purposes of comparison, see also this interactive graphic, here.)

This proves again, that owning solid assets such as stocks (you have to pick the right ones.)

On the subject of future inflation, the desired rate of 2% will be far off.

I only expect a real increase of our gross-national product during 2023 of only 3% (about the expected increase in population including immigrants). Judging by the recent past and accounting for Congress’ spending binge, I expect another 2.7 trillion dollars in the U.S. debt.

This is about 12% of the gross national product. Since we learned from above, that debt and inflation will go hand-in-hand, we can expect a yearly inflation of 7% (debt increase less 3% GDP increase makes 9%).

Mind you, this is "new" inflation.

On top this, we still have the burden of "legacy" inflation accumulative from at least 10 years (a every homemaker will tell you, once her budget food prices goes up, they never go down). As I said before, as in physics, inflation is an irreversible process.

Keep on smiling, and remember, we had much worse times in the past.

Happy New Year and buy stocks when they are low!

Here are my picks: A price earnings ratio (PE) less than 20, and yield above 4% annually.

Recall what I said in my last column about the dismal future of the semiconductor industry? There is this according to the Washington Examiner.

So much for government’s planning.

Dr. Hans Baumann, a former Corporate Vice President and founder of his company, is a well known inventor, economist, and author having published books on scientific, economic, and historical subjects. Read Dr. Hans Baumann's Reports — More Here.