I’ve been writing financial newsletters for 15 years. I have seen a few cycles. There have been good times and bad times, thrills and spills.

This is about the worst year ever.

People generally sign up for newsletters when they’re looking for ways to make money. They’re excited about making money.

What’s interesting is that, in the grand scheme of things, the markets aren’t all that bad. The Standard & Poor’s 500 is down about 10% from the highs; nothing serious. Volatility is low. There are still initial public offerings (IPOs) and pockets of speculation. The bear market was obviously a lot worse last year, but the interesting thing about vicious bear markets is that there are often opportunities amidst the chaos.

This year: no opportunities. Just a slow grind with rates lower, the dollar higher, and stocks marginally lower. Apart from the AI stuff a couple of months ago, there is nothing to get excited about.

The Economy Is Getting Weaker

I just solicited the first wave of sign-ups for my annual conference—got about half of what I had last year. Not that my conference is that expensive, but people aren’t much in the mood to spend $995 and travel halfway across the country when business is slowing to a crawl.

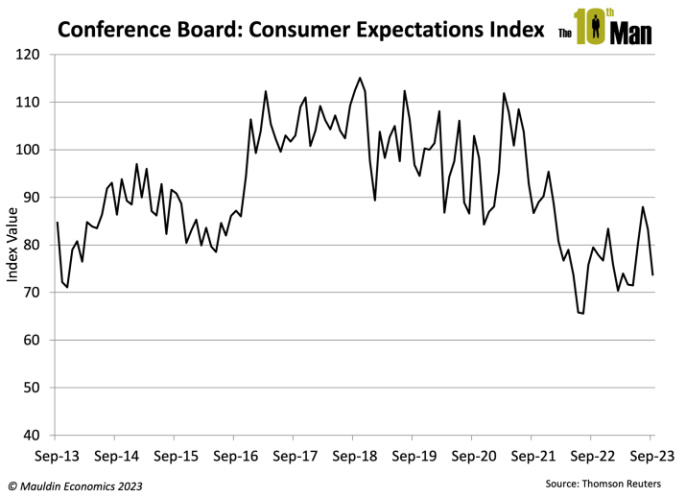

And the crazy thing about this is we know the economy is getting weaker. It is in our words and actions. On Tuesday, we got the Conference Board Consumer Confidence numbers. The expectations series tell us what people think is going to happen in the future. People are not so optimistic, as you can see from the chart. And yet, bond yields keep chugging higher.

This is a paradox. The economy is bad and getting worse, and the bond market acts as if it is good and getting better. Of course, there are supply factors contributing to bond weakness—the massive amounts of Treasury issuance and the probable selling of US Treasuries out of China and elsewhere. Some of the worst price action I’ve seen anywhere—send the intern around to get a box of upticks.

Remember that we have our Email Beige Book—it’s a constant stream of people telling me how bad things are getting. There is no doubt about it: We will get our recession. The question is: Will it be the first recession with higher interest rates?

The 2006–2007 Parallel

If you’ve seen the movie The Big Short, you might be led to believe that the guys at FrontPoint and Michael Burry were the only ones who knew that a housing crash was coming. This is false. Lots of people knew it was coming. They were the ones who took the time to research how to put the trade on and had the courage and conviction to stick with it.

If you remember, in 2006–2007, it took a long time for the market to roll over. Just like today, the data was deteriorating throughout 2006, and we didn’t really get a taste of the financial crisis until February 27, 2007, the day we walked in, and the ABX, the subprime mortgage index, gapped lower by 10 points.

And even after that, the stock market went up for four more months. What was remarkable about the Big Short trade wasn’t the ultimate payoff but how long people had to wait for the explosion. I remember what it was like, in those days, back on the ETF desk—just watching the market grind higher every day with the VIX below 10. Frustrating doesn’t begin to describe it.

There has been some discussion about whether we will get a soft landing or a hard landing. Jim Bianco, president and founder of Bianco Research, a provider of data-driven insights into the global economy and financial markets. thinks we will get no landing—things will continue as normal, and rates will trend higher. The one thing I learned from my time on Wall Street is that there is no such thing as a soft landing… ever. It is a unicorn. There are only hard landings.

The Fed absolutely overtightened, and there will be consequences.

So, when I sit here at my desk and watch the markets every day, I think about those Big Short guys and how they had the fortitude to stick with those positions, even when the banks were spoofing the marks against them. Then, when it worked, it worked. And it worked for months.

You might recall from the movie that Burry took the tradeoff prematurely. Only Steve Eisman (Mark Baum) let it ride. If the Fed cuts rates—or when the Fed cuts rates—it will cut much more than you think is possible. Use your imagination. I think 300 basis points would be conservative.

You might recall that Marvin the Martian tried to destroy the Earth with his Illudium Q-36 Explosive Space Modulator. When it didn’t work, he said, “Where’s the kaboom? There was supposed to be an earth-shattering kaboom!” We are all Marvin now.

Cheer Up

Here is some great new music for you. Please listen to my latest set, The Princess.

_______________

Jared Dillian writes the investment newsletter, The 10th Man, for Mauldin Economics. Subscribe here to receive a new issue in your inbox every Thursday.

© 2026 Newsmax Finance. All rights reserved.