President Donald Trump’s joint session speech, “America is Back,” was one of his best since entering politics. It was optimistic, energetic, and hopeful. He outlined plans to grow the economy, reduce energy costs, lower taxes, and bring manufacturing and new businesses back to America.

Since the president’s inauguration, crude oil prices have dropped by 19%, from $80 to $65. Lower energy prices mean lower inflation, which is excellent news for consumers.

Despite the obstruction from the district court justices appointed by Presidents Obama and Biden, the President has accomplished more in 42 days than Joe Biden did in 1,461 days.

The Biden dumpster fire needs to be extinguished.

The remnants of the economic damage inflicted by the Biden administration over the past four years, coupled with the recent obstruction and resistance from every Democrat party member in the House and our judiciary, if unchecked, would have led the country toward an economic recession.

Thankfully, Trump is working to lower inflation starting with energy prices, reshore manufacturing to create thousands of U.S. jobs, cut government spending waste, and reestablish American exceptionalism.

During Biden’s administration, inflation hit an understated 40-year high of 9.1% on July 22, 2022. Unfortunately, the price increases stemming from the Biden administration’s reckless fiscal spending, including the Inflation Reduction Act and the Federal Reserve’s policies, have not eased nearly enough to benefit consumers, as wages have not kept pace with inflation.

Over the past four years, excessive government spending and the Federal Reserve’s decades-long policy of zero-interest rate policy (ZIRP) have inflated significant bubbles in the stock, property, and credit markets, contributing to today’s inflation. Given the current stratospheric valuations, these unsustainable bubbles are likely to burst soon.

On the Newsmax website in December, I made five predictions for 2025:

Number one was:

Market Correction: A substantial correction, 50% or more, is coming in the U.S. stock markets when Big Tech’s AI bubble explodes.

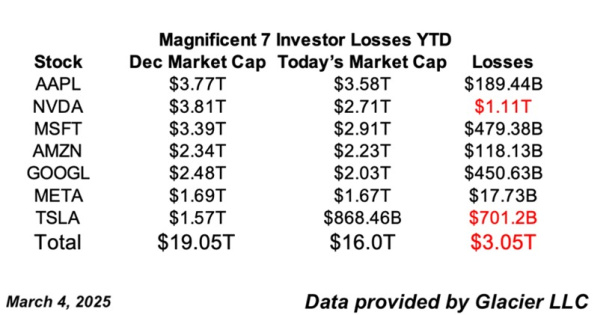

Nvidia was down 30% from its December highs this morning, and Tesla was down 43%.

Nvidia’s market cap was $3.8 trillion. Nvidia’s market cap is $1.1 trillion lower than its December highs, and investors have lost $1.1 trillion.

Tesla’s market cap was $1.6 trillion. Today, Tesla’s valuation is $700 billion lower than its December highs, and investors lost $700 billion.

Since the third quarter of 2024, family offices, institutional investors, and hedge funds have been net sellers of equities due to extremely high valuations, while retail investors continue buying stocks at an unprecedented rate and can’t seem to buy enough.

Additionally, Commodity Trading Advisors (CTAs) will likely reverse approximately $200 billion from their long equities’ positions, causing further market declines in an already overvalued market that has not seen a meaningful correction in over a decade.

CTAs utilize momentum-following strategies, which they believe provide them an advantage in managing their clients’ investments in equities, futures, fixed income, commodities, and other asset classes. This is noteworthy because the CTA trades are large and may increase volatility, disrupting markets.

Market indicators are flashing red – take profits!

We observed a “yield curve inversion” in February when the 10-year Treasury note traded below the 3-month bill. A yield curve inversion means bond traders believe an economic recession is likely. Additionally, the Atlanta Fed revised the January-March Gross Domestic Product to -2.8% from +2.3%. This forecast reinforces the bond market’s caution. This GDP data will reflect the cuts in USAID spending and government jobs.

Why is the current 10-year yield of 4.24% significant? The interest rates on all consumer loans and mortgage products are based on the 10-year yields. The 10-year was trading at 4.80% before President Trump was inaugurated.

President Trump’s landslide victory provided him with a strong mandate for change. The rise of DOGE and the commitment to exposing the corruption, waste, and fraud within the political establishment signify this change. The public is weary of dishonest politicians, divisive political tactics, and bias in government agencies and the judiciary. We can be hopeful that President Trump will make America great again once the political establishment is held accountable.

______________

Mitch Feierstein knows the financial industry inside out. For the past four decades he consistently created opportunity and value where others have failed to look. He is a successful investor and CEO of the Glacier Environmental Fund Limited. Prior to Glacier, he was Senior Portfolio Manager of the Cheyne Carbon Fund, part of one of the largest and best-respected hedge-fund groups operating in Europe. He has acted as a consultant for a number of governments in their disaster and contingency planning. He is the author of Planet Ponzi, the only insider's account of the credit crisis detailing; How we got into the mess, what happens next, and what you need to do to protect yourself. He divides his time between London and New York.

© 2026 Newsmax Finance. All rights reserved.