Remember how the Biden administration, the Fed, and corporate media has kept saying the economy and job market were “strong”? Well, it turns out that isn’t the case.

Federal Reserve Chair Jerome Powell certainly had that in mind during his Friday speech. He said a lot of things, but this is pretty much all everyone heard:

The time has come for policy to adjust.

The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

Today, I’ll do my best to explain what Powell meant with those words.

Economic outlook: “Uneasy”

The Federal Reserve’s job is to conduct monetary policy "so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates."

There’s a lot to unpack there – the St. Louis Fed restates the mandate in plain English as:

Keeping our economy healthy… pursuing the economic goals of maximum employment and price stability.

Right now the Fed is uneasy because the balance of economic risks has shifted – according to Minneapolis Fed President Neel Kashkari. Generally, Federal Reserve insiders are talking a lot more about the weakening job market than inflation or the stability of the financial system.

For example, San Francisco Fed President Mary Daly said weeks ago she was gaining confidence that inflation was returning to the central bank's 2% target. True, CPI has declined significantly from its fever-hot levels we’ve seen over the last three years. Speaking for the “doves” on the Federal Open Market Committee (FOMC), Daly admitted they were “open to rate cuts.”

Powell’s Jackson Hole speech pretty much ends the debate.

At the central bank's upcoming policy meeting on September 17-18, they will cut interest rates.

Even though the FOMC has 12 members, it’s customary that their decisions on interest rate adjustments are unanimous. It’s a strange tradition, considering the wide variety of conflicting opinions on the FOMC itself, let alone the seven presidents of the reserve bank branches not represented on that committee.

For example, Kansas City Fed President Jeffrey Schmidt seems to disagree:

I still believe quite strongly that we really need to turn this inflation number to 2%. It has to be sustainable. Having the labor market cool is helping that, but there’s still more work to do.

I really do believe you’ve got to start looking at a little bit harder relative to where the 3.5% unemployment number was and where it is today in the low 4s.

Schmidt even referred to the Fed’s current interest rate as “restrictive, but they’re not overly restrictive.”

Doesn’t that sound surprising? How many times have you read headlines like:

U.S. Interest Rates Highest in Two and a Half Decades

Or:

Fed’s Rates Highest Among Developed Nations Worldwide

These headlines are calculated to shock you. Here’s the thing: The average Effective Federal Funds Rate (EFFR) over the last century has been 4.6%. It’s been over 20%!

Interest rates were double digits some 10% of the time.

So those headlines I mentioned above? They’re both technically correct and completely misleading.

Mortgage rates were 18.5% in 1981 and you know what? The world didn’t end. The economy didn’t collapse. That's what Schmidt meant when he called current rates “restrictive” but not “overly” so. Current interest rates mean credit is a little bit more expensive than the long-term average, but they aren't 10%-20% by a long shot. That’s important, because it’s one of the only tools the Fed has in its arsenal to combat inflation if it does start heating up again.

On the other hand, Philadelphia Federal Reserve President Harker thinks rates should be heading down:

I am very proud of being at the Fed, where we are proud technocrats. That’s our job. Our job is to look at the data and respond appropriately. When I look at the data as a proud technocrat, it’s time to start bringing rates down.

Whether you're a proud technocrat or an ashamed one, though, one thing is clear: Your decisions are only as good as your data.

How many times has Chairman Powell told reporters he's "data-dependent"? How many times has the man said, "We can't decide what we'll do before we see the data." Dozens (if not hundreds).

So what if the data is wrong?

One million jobs vanish overnight

For the last three years, the left and the right have been hotly arguing over the true state of the American economy. The White House tells us we've never had it so good, that we were all richer than ever before in U.S. history and anyone who told you different was lying. The right said prices were too high, not coming down fast enough, and the numbers on the White House spreadsheets didn't reflect the truth of everyday Americans and their financial struggles.

With that ongoing debate as a backdrop, the recent revelation that the Bureau of Labor Statistics (BLS) had accidentally overstated jobs by one third wasn't well received:

The Bureau of Labor Statistics (BLS) finally admits that they have been lying about job numbers. 1 million jobs disappearing.

That means, in hindsight, every single surprisingly large "jobs report beats expectations" headline over the last year or so was wrong.

And the U.S. job market is in far worse shape than any government employee would admit.

Note this isn't quite the biggest mistake the BLS has ever made. It's in the top four or five biggest, though...

Anyone who wondered how both unemployment and job openings could rise at the same time is probably feeling vindicated right now.

Job-seekers have been taking to social media for months now to announce how impossible it is to find a professional job these days? They're probably feeling a little vindicated right now, too. I can hear them shouting at their computer screens, "That's what I've been saying!"

Unemployment going up means businesses are laying off workers. Fewer job openings means businesses are concerned about profitability and growth in the short term.

You know what that means...

Are we already in recession?

According to the Sahm rule, yes. According to a tweaked, more reliable variant of the Sahm rule, also yes.

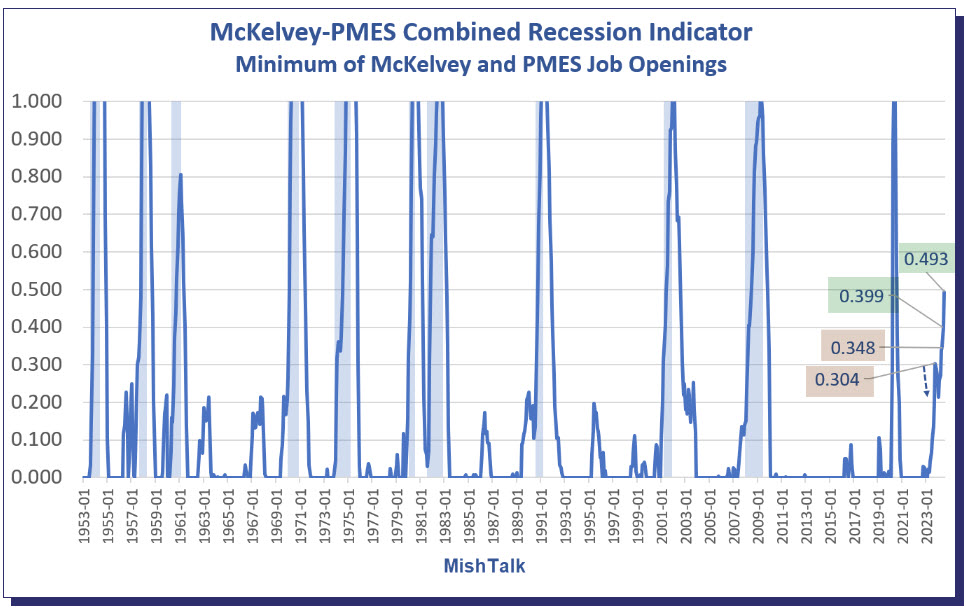

Over the last 11 recessions, there are no false positives or negatives on the McKelvey-PMES Combined Recession Indicator, except perhaps the current readings.

Below is a graph that Mike Shedlock put together combining the "McKelvey" and "PMES" recession indicator metrics. They're complicated but note how they haven't indicated a single false positive in the last 81 years:

Via MishTalk

This is pretty abstract stuff... If you love squinting at spreadsheets and number-crunching in your spare time, you can take a deep dive into the nuts and bolts here. For everyone else, just take note how the McKelvey-PMES indicator is skyrocketing yet again.

Is a recession a sure thing, based on this information? Nope, it could turn out that this recession indicator only works eleven consecutive times and our current situation is a false positive... But I wouldn't bet on it.

By now, you probably understand why the Fed's worried...

If the Fed's worried about recession, should you be, too?

If a recession is already underway, or even if it’s just imminent, then the Fed is likely to drop interest rates back to zero. That's just about the only thing left that can act as financial adrenaline. But that would leave the current inflation rate still 50% over their target.

This situation, if it plays out, would be similar to what happened after the 2008 financial crisis, which the Fed followed with a decade of near-zero interest rates. Except this time, because people are buried under piles of debt, and the national debt is SO much higher, the fallout could be much worse.

It's already reminding me an awful lot of the opening acts of Japan’s stagflationary “lost decade." (Imagine ten consecutive years of little-to-no economic growth, no opportunities, rampant unemployment...)

When recession hits, the Fed will need to keep interest rates nailed to the floor for quite some time. The problem with that is, a recession cannot be avoided. It can only be postponed. We'll be forced to endure a much more severe economic crisis, for longer.

We don't know what the future holds. But we do know what we can do today to prepare for an uncertain tomorrow...

Safe havens from every economic storm

One potential way to guard your retirement savings and preserve your buying power in the face of major economic uncertainty is to ensure your assets are diversified properly. (We cover more on proper diversification here.)

For example, there are certain assets that act more like a “safe haven” for your hard-earned dollars than others. In fact, these assets are so important, we’ve devoted an entire education page to them.

In addition physical precious metals like gold and silver have proven themselves historically to be a great store of value and financial stability. Most financial assets available to us only do well when everything else does well, too! That's great during the good times, and awful during the bad times. The point of diversification is that no matter what happens, some portion of your savings stays relatively stable, or even grows, even when the rest of the world is on fire.

_______________

Phillip Patrick is Birch Gold Group’s primary spokesman and educator. He was born in London and earned a politics and international relations degree at the prestigious University of Redding in Berkshire, England. Growing up in London, he saw the risks of government overreach and socialist policies first-hand. He spent years as a private wealth manager at Citigroup on Lombard Street (the Wall Street of London). He joined Birch Gold Group as a Precious Metals Specialist in 2012.

© 2026 Newsmax Finance. All rights reserved.