Traditionally, so long as you have the financial resources to do so, retirement is a fairly simple and straightforward endeavor.

The general idea goes like this: You make a plan for your retirement, you save for retirement, then you stop working, officially file for Social Security benefits and officially retire.

For some people, that’s exactly how it works out.

But for most people, even the best-prepared savings plans need to be adjusted at times. For still others, alternative retirement options need to be explored.

One of those alternatives that has become more popular in recent years is the idea of a “phased-in retirement:”

Fidelity Investments “State of Retirement Planning" study notes that two-thirds of those it surveyed across generations hope for phased retirement – steadily cutting back their work hours over several years before saying goodbye to colleagues for the last time. The Allianz Life 2024 annual consumer survey finds that 47% of its participants think retirement should be a slow transition away from full-time work."

It’s an interesting idea to ponder. But there is still at least one additional question to consider that factors into the current economic picture.

Why would you choose to “phase in” your retirement?

Kelly LaVigne, VP of Consumer Insights at Allianz Life added a key insight that helps to explain why someone might pursue this newer "phased retirement" idea:

Some people may want to slowly transition away from full-time work in order to stay busy, but for many Americans it is necessary in order to feel financially confident that your money will last your lifetime. Working longer will put off when you start drawing down on retirement assets. You could also benefit from staying on an employer health plan.

Well, obviously, feeling “financially confident” that your money will last as long as you do is crucial to a successful retirement.

We know this is a major concern many Birch Gold customers have. I personally didn’t realize just how big a concern it was…

Allianz also found that most people worry more about running out of money in retirement than death itself!

The worry of running out of money has increased in recent years. In 2024, 63% say they worry more about running out of money than death, up from 57% in 2022.

Gen Xers are the most likely to say this with 71% more worried about running out of money than death, compared to 64% of millennials and 53% of boomers.

Death is scary, but lack of financial insecurity is even scarier for nearly 2/3s of Americans. That’s shocking.

The three major contributing factors, according to the same survey:

- Social Security stability

- High taxes

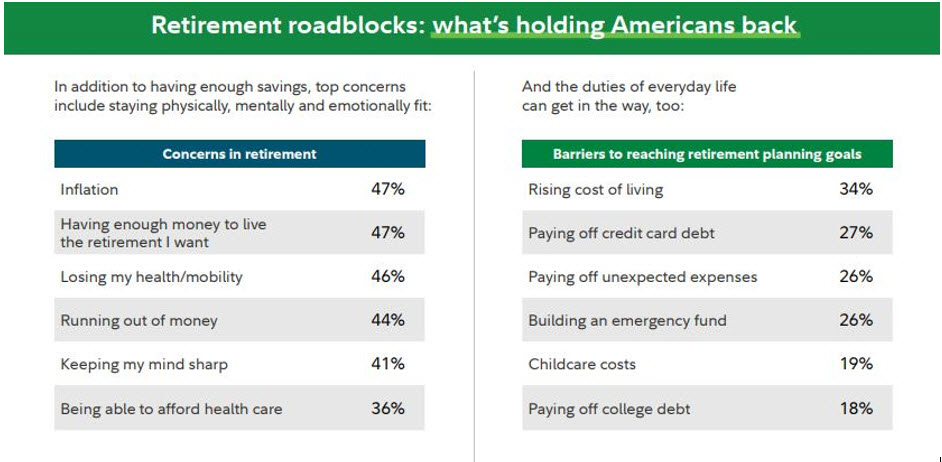

Fidelity published a similar study that reached a similar conclusion. Namely that persistent inflation, piles of debt, and unexpected expenses were holding people back. (I suspect that Fidelity’s survey included responses from younger Americans, based on the results.)

You can see a chart taken from the study below:

Via Fidelity

The same Fidelity study added another important reason people choose to “unretire”:

37% say it’s to cover essential expenses,

33% say it’s to increase income for discretionary expenses.

More than 1/3 of people give up on retirement simply because they can’t afford it.

This is also shocking. What went wrong?

Did the pandemic recession end their careers abruptly?

Did they underestimate their essential expenses – say, healthcare costs? Perhaps a healthcare emergency cracked their nest egg?

Did they overestimate the growth of their retirement savings?

Did Social Security’s COLA fail to keep up with their rising cost of living?

Did they ignore the “retirement red zone”? Or possibly neglect to shift into the appropriate phase of retirement saving?

There’s no way to know for sure.

What we DO know is, we should do our best, when planning for retirement, to prevent this sort of do-over…

Preventing retirement regrets starts well before retirement

Whether you’re already phasing in a full retirement, or just considering the idea for the first time, don't forget you still need to keep a solid retirement plan.

You’ll need to know your essential expenses (and how they’ll change).

You’ll need a handle on your current retirement savings, and the sort of performance you can expect in the future.

You’ll need to know your time horizon, and when you should shift from playing offense to defense. That includes proper diversification of your hard-earned savings.

To bring your personal risk-and-reward profile into balance, you may need to diversify with safe haven assets such as physical precious metals. That’s because metals like gold and silver have proven themselves historically to be a great store of value and financial stability.

So take a moment and consider whether diversifying your retirement savings with physical precious metals could help prevent future retirement regrets. Once you finally do make the leap to retirement, you should be able to enjoy your golden years without worrying about your bills.

_______________

Phillip Patrick is Birch Gold Group’s primary spokesman and educator. He was born in London and earned a politics and international relations degree at the prestigious University of Redding in Berkshire, England. Growing up in London, he saw the risks of government overreach and socialist policies first-hand. He spent years as a private wealth manager at Citigroup on Lombard Street (the Wall Street of London). He joined Birch Gold Group as a Precious Metals Specialist in 2012.

© 2026 Newsmax Finance. All rights reserved.