U.S. equity funds saw robust inflows in the week to October 1 on renewed bets of rate cuts, as an inflation report eased worries that a buildup in prices would push the Federal Reserve to delay policy support for a weakening labor market.

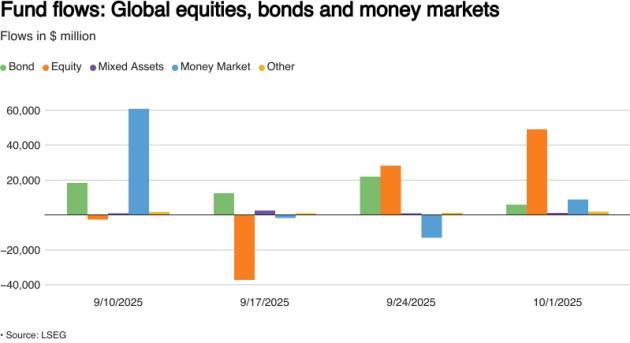

Investors bought a net $36.41 billion worth of U.S. equity funds during the week in their largest weekly net purchase since November 13, 2024, LSEG Lipper data showed.

The large-cap funds segment stood out as it drew a net of $40.75 billion in weekly inflows, the largest amount since at least 2022.

Small-cap and mid-cap funds, however, witnessed outflows to the tune of $2.59 billion and $2.28 billion, respectively.

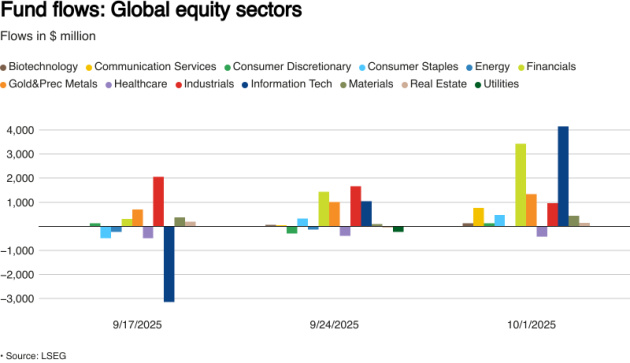

Among sectoral funds, investors scooped up tech sector funds of net $3.04 billion after two weeks of net sales. They also added funds of $652 million and $497 million in the industrial and communication services sectors, respectively.

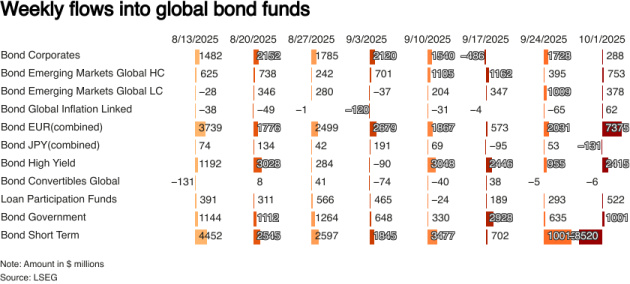

Investors, meanwhile, ditched a net $1.58 billion worth of bond funds, halting their 23-week-long trend of net purchases.

They divested U.S. short-to-intermediate government and treasury funds of a net $9.37 billion in their largest weekly sales since at least January 2022.

At the same time, U.S. short-to-intermediate investment-grade funds and general domestic taxable fixed-income funds gained net inflows of $1.95 billion and $1.55 billion, respectively.

Weekly net investments in money market funds, meanwhile, jumped to a four-week high of $47.08 billion during the week.

© 2026 Thomson/Reuters. All rights reserved.