Gold prices could potentially rise to $5,000 per ounce or higher if the Iran-Israel conflict escalates significantly, driven by its status as a safe-haven asset during geopolitical turmoil.

Even major Wall Street banks, including Goldman Sachs and Bank of America, are advising clients gold could surge beyond $4,000 an ounce in the next 12 to 18 months.

The ongoing Iran-Israel conflict has already pushed gold prices higher, with spot gold reaching $3,451 on June 16, 2025, and trading around $3,398 on June 17, 2025, after additional Israeli strikes on Iranian targets.

If the conflict intensifies — with Iran retaliating with drone strikes, disrupting oil chokepoints like the Strait of Hormuz, or draws the U.S. in directly — investors are likely to flock to gold, driving prices upward.

Special: $188,170 More in Social Security Payments Now Available for a Limited Time, Click Here.

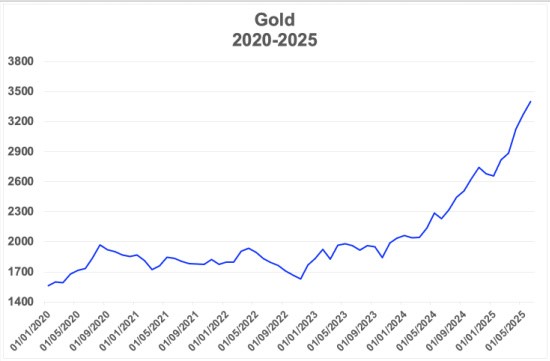

“In 2024, gold returned 28%, and year-to-date 2025, it is up 30%,” notes Mitch Feierstein, a New York and London-based investor. “Traditionally, investors have fled to ‘safe assets’ such as the U.S. dollar and U.S. bonds during market uncertainty. However, this is no longer true. Gold has become a new proxy for the U.S. dollar, and we will see new highs before the end of the summer.”

(Newsmax graphic. CME data.)

Posts on X suggest that a hard Iranian retaliation could push gold to new highs, potentially toward $4,000.

Historical precedent supports this: gold surged over 1% to $2,661.63 in October 2024 after Iran fired ballistic missiles at Israel, reflecting safe-haven demand during Middle East tensions.

Current prices around $3,400 already reflect heightened tensions, but a severe escalation could even drive a 17%–30% rally, which would take gold to the $3,397-$4,420 range.

The first indicator of rising gold prices is oil.

Escalation could disrupt oil supplies, particularly if the Strait of Hormuz is blocked, through which 20% of the world’s global oil flows. Analysts estimate oil prices could hit $100 per barrel or higher in a worst-case scenario, stoking inflation. Higher oil prices increase production and transportation costs, which then raise the prices of goods.

“I am bullish on gold and all precious metals, as well as commodities and energy, as these sectors have far greater upside potential than today’s overvalued stock markets,” Feierstein says.

Gold, as an inflation hedge, tends to rally when the oil rises in price. For instance, gold hit a record $3,500 per ounce in April 2025 amid earlier Middle East tensions and inflationary pressures.

Rising inflation could delay or reduce expected U.S. Federal Reserve interest rate cuts, keeping real yields low. This would also support gold, which thrives in low-interest-rate environments.

Goldman Sachs projects gold reaching $3,700 per ounce by the end of 2025 and $4,000 by mid-2026, driven by strong central bank purchases and geopolitical risks.

Bank of America also sees a path to $4,000 within 12 months from June 2025.

Urgent: Wall Street Legend Issues Urgent Warning For All Investors... See Here.

Central banks, particularly in China and India, have been diversifying reserves with gold, yet further boosting demand. This structural buying could amplify price gains if the Mideast conflict escalates.

Feierstein notes: “As I’ve pointed out to my investors for a few years, central banks have been strategically increasing their holdings in gold, and you don’t want to be on the wrong side of the gold trade. Be patient and accumulate on pullbacks!”

Many believe China has already been hoarding gold, buying tons not captured by data reports.

Another indicator for gold is the U.S. dollar. Gold is priced in U.S. dollars (XAU/USD), and a weaker dollar typically supports higher gold prices. Recent posts note USD weakness alongside softer U.S. inflation data, which could further propel gold if geopolitical risks intensify.

However, a strong safe-haven demand for the dollar during a crisis could cap gold’s upside, as seen in past risk-off events.

Another factor is the war itself. Some market sentiment, as expressed on X, suggests that major asset classes (including gold) are not pricing in a prolonged war, indicating expectations of a contained conflict.

Alert: Prepare for Any Emergency. Get This Radio Now, Before You Need It!, Click Here.

Direct U.S. military engagement, as speculated in some X posts, could amplify market panic, driving gold toward or beyond $4,000.

A full-blown regional war or Strait of Hormuz closure could drive gold well above $4,000, potentially to $4,500 or higher, as speculated in worst-case analyses.

If you believe escalation is likely, holding or buying gold at current levels could be prudent, given its safe-haven status. However, analysts caution that prices are high, and a de-escalation could trigger a pullback.

© 2026 Newsmax Finance. All rights reserved.