Hedge fund returns climbed in June, as broader stock markets hit record highs and markets weathered turbulence around U.S. trade uncertainty, according to a Goldman Sachs report and sources familiar with the funds.

Hedge fund stock pickers returned over 3% in June and are up over 6% for the year so far, while systematic hedge funds trading stocks saw performance declines for June of 0.68% but are still up 11.91% for the year, said the Goldman Sachs' prime brokerage note to sent to clients July 1 (see chart, below).

The S&P 500 and the Nasdaq Composite ended June at record closing highs, while an index that tracks the dollar against major peers dropped.

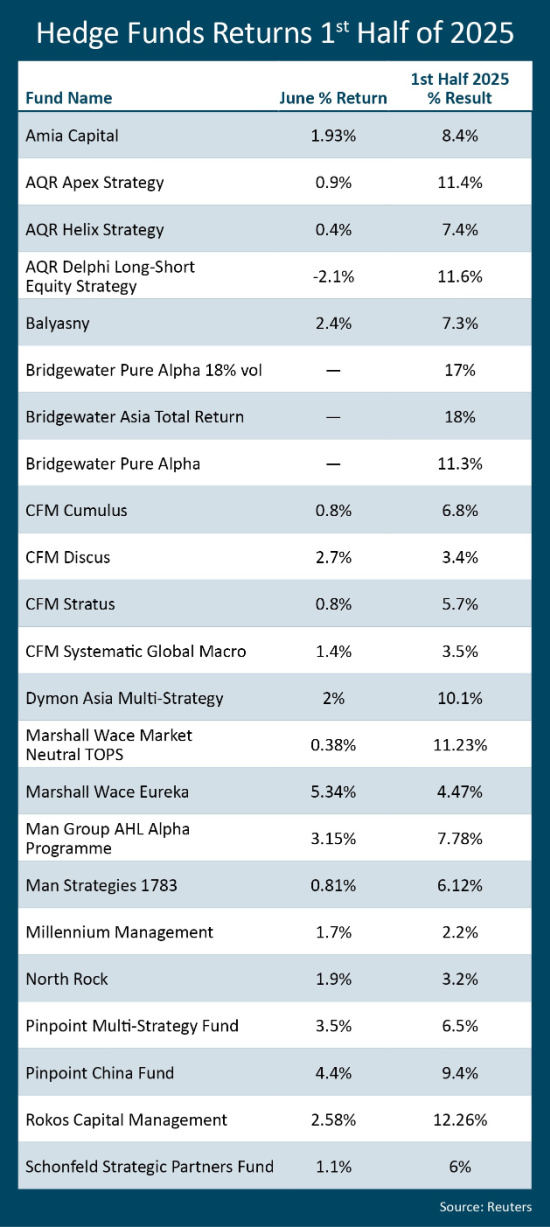

Some of the biggest multi-strategy funds posted positive returns, including Schonfeld Strategic Partners, with a 1.1% return for June that added a 6% result for the year, said a source familiar with the fund.

Bridgewater Associates' main funds ended the first half of 2025 with gains, with the flagship Pure Alpha 18% volatility fund posting a 17% return in the first half.

The $73.7 billion UK hedge fund Marshall Wace returned 0.38% in its Market Neutral TOPS fund, bringing its half-year performance to 11.23%. Its Eureka fund returned 5.35% in June and is up 4.47% for 2025 so far, said another source familiar with the fund's results.

Tailwinds for stock pickers riding on rallying equity markets included technology firms as well as trading on market volatility. Losses stemmed from health care stocks, the Goldman data showed.

Systematic stock traders had their first performance decline in eight months, Goldman's note added. Negative performance came from consumer discretionary stocks and getting stuck in crowded short positions. A short position expects an asset price to decline.

© 2026 Thomson/Reuters. All rights reserved.