The number of Americans filing new applications for jobless benefits increased more than expected last week and the unemployment rate appeared to have picked up in May, suggesting layoffs were rising as tariffs cloud the economic outlook.

The report from the Labor Department on Thursday showed a surge in applications in Michigan last week, the nation's motor vehicle assembly hub. The number of people collecting unemployment checks in mid-May was the largest in 3-1/2 years.

The dimming economic outlook was reinforced by other data showing corporate profits declining by the most in more than four years in the first quarter, pulled down by nonfinancial domestic industries.

A U.S. trade court on Wednesday blocked most of President Donald Trump's tariffs from going into effect in a sweeping ruling that the president overstepped his authority. They were temporarily reinstated by a federal appeals court on Thursday, adding another layer of uncertainty over the economy.

"This is a sign that cracks are starting to form in the economy and that the outlook is deteriorating," said Christopher Rupkey, chief economist at FWDBONDS. "There is nothing great about today's jobless claims data and the jump in layoffs may be a harbinger of worse things to come."

Urgent: U.S. Dollar Ousted, Global Powers Are Turning Against America... See Here

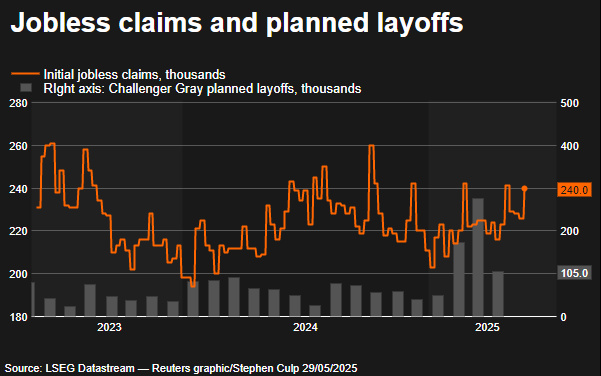

Initial claims for state unemployment benefits rose 14,000 to a seasonally adjusted 240,000 for the week ended May 24, the Labor Department said. Economists polled by Reuters had forecast 230,000 claims for the latest week.

They said Trump's aggressive trade policy was making it harder for businesses to plan ahead, a sentiment echoed by a Conference Board survey on Thursday, which showed confidence among chief executive officers plummeting in the second quarter.

Initial Jobless Claims

Unadjusted claims for Michigan jumped 3,329. The automobile industry has been hit with a 25% duty on parts. There were also notable increases in benefits applications in Nebraska and California. Despite the rise in claims, worker hoarding by employers following difficulties finding labor during and after the COVID-19 pandemic continues to underpin the jobs market.

That was corroborated by the Conference Board survey, which also showed most captains of business anticipated no change in the size of their workforce over the next year even as about 83% said they expected a recession in the next 12-18 months.

Nonetheless, layoffs are creeping up. A report from the Bank of America Institute noted a sharp rise in higher-income households receiving unemployment benefits between February and April compared to the same period last year.

Its analysis of Bank of America deposit accounts also showed notable rises among lower-income as well as middle-income households in April from the same period a year ago.

Claims could remain elevated in the coming weeks, in part reflecting difficulties adjusting the data for seasonal fluctuations, following a similar pattern in recent years.

Minutes of the Federal Reserve's May 6-7 policy meeting published on Wednesday showed while policymakers continued to view labor market conditions as broadly in balance, they "assessed that there was a risk that the labor market would weaken in coming months."

Expert: Why the Next Crash Could Be Even Worse Than 2008... Read Here

The U.S. central bank has kept its benchmark overnight interest rate in the 4.25%-4.50% range since December as officials struggle to estimate the impact of Trump's tariffs, which have raised the prospect of higher inflation and slower economic growth this year.

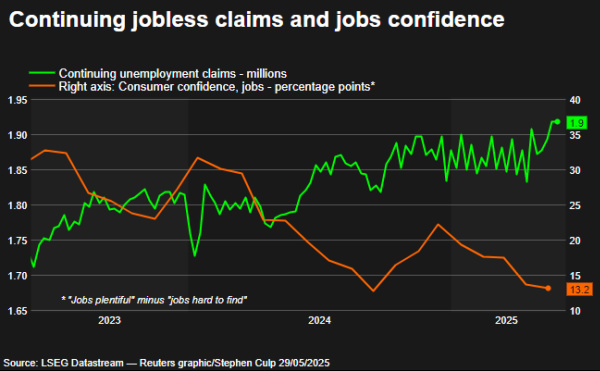

SWELLING UNEMPLOYMENT ROLLS

The number of people receiving benefits after an initial week of aid, a proxy for hiring, increased 26,000 to a seasonally adjusted 1.919 million during the week ending May 17, the highest since November 2021, the claims report showed. The elevated so-called continuing claims reflect companies' hesitance to increase headcount.

Continuing Jobless Claims

Continuing claims covered the period during which the government surveyed households for May's unemployment rate. They increased between the April and May survey periods, suggesting an uptick in the unemployment rate this month.

"This raises the risk that the unemployment rate could tick up to 4.3% in the May employment report," said Abiel Reinhart, an economist at JP Morgan.

The jobless rate was at 4.2% in April. Many people who have lost their jobs are experiencing long spells of unemployment.

With profits slowing, there is probably little incentive for businesses to boost hiring. Profits from current production with inventory valuation and capital consumption adjustments dropped $118.1 billion in the first quarter, the biggest decline since the fourth quarter of 2020, the Commerce Department's Bureau of Economic Analysis (BEA) said in a separate report. Profits surged $204.7 billion in the October-December quarter.

Profits from domestic nonfinancial firms dropped $96.7 billion. Companies ranging from airlines and retailers to motor vehicle manufacturers have either withdrawn or refrained from giving financial guidance for 2025, citing tariffs uncertainty.

Alert: Trump Whistleblower Reveals China's Global Strategy... See Here

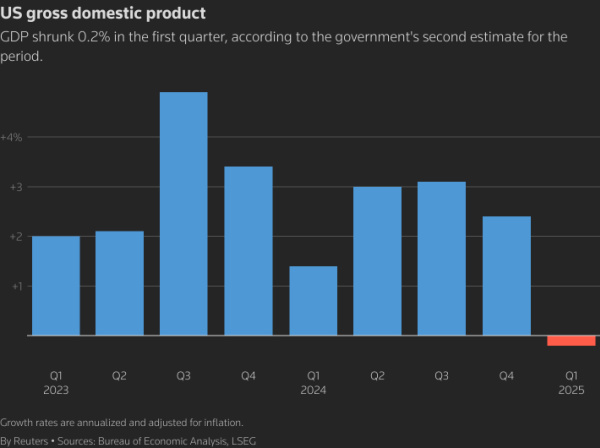

Businesses front-loaded imports, resulting in a record trade deficit that contributed to gross domestic product declining at a 0.2% annualized rate in the January-March quarter, the BEA's second estimate of GDP showed.

Some of the imports ended up as inventory in warehouses, with growth in consumer spending downgraded to a 1.2% rate from the initially reported 1.8% pace.

The economy was initially estimated to have contracted at a 0.3% pace. It grew at a 2.4% rate in the fourth quarter.

A measure of domestic demand was also revised lower. Other alternative measures of growth, gross domestic income and gross domestic output also showed the economy contracting at a 0.2% pace in the first quarter. There were small downward revisions to inflation.

"GDP will likely either contract again in the second quarter or hold in low gear, but the economy is unlikely to slip into recession," said Bill Adams, chief economist at Comerica Bank.

© 2026 Thomson/Reuters. All rights reserved.