As has often been the case over the past two years, Nvidia's stellar earnings have helped calm a tech sector nervous about bubble-like AI valuations.

Meanwhile, hopes of another U.S. interest rate cut this year have all but disappeared.

Demand for Nvidia's chips was never the root of the AI bubble worries, which are mostly focussed on whether the gigantic AI infrastructure spend will eventually pay off in industry-wide returns now that debt is increasingly being used to fund it.

Nvidia's business has become increasingly concentrated in its fiscal third quarter, with four customers accounting for 61% of sales.

But shares in the world's most valuable company jumped more than 5% overnight after the results, with Nvidia's slowing but still-impressive revenue projections showing a re-acceleration in a year's time. And, needless to say, the AI bellwether doesn't see stock values as being in a bubble.

The overnight stock move should add more than $200 billion in market cap at the open later on Thursday, and that's lifted S&P 500 and Nasdaq futures more than 1% out of hours. The S&P 500 had broken a four-day losing streak before the Nvidia release.

Tech-heavy stock indexes in Tokyo, Seoul and Taipei surged 2-3% earlier today. And Wall Street's VIX "fear index" of implied volatility has fallen back about three points to 21.

Digital token bitcoin remained under a cloud, however, and struggled to regain the $92,000 level overnight.

The other big market development on Wednesday was the gradual disappearance of December Fed easing bets, with the Bureau of Labor Statistics saying it won't now publish an October employment report and the November release won't be published until December 16 — six days after the Fed meeting.

Fed futures now see little more than a one-in-five chance of a cut next month — from a four-in-five chance earlier this month. September's long-awaited payrolls report is due out later today and expected to show a 50,000 jobs gain and unchanged unemployment rate of 4.3% — although it is likely to be too far out of date to materially affect Fed thinking.

And as economic data releases return following a hiatus due to the 43-day government shutdown, the Atlanta Fed's "GDPNow" model shows overall U.S. growth tracking an annualized rate of 4.2%.

Minutes of the central bank's October meeting were also released overnight and revealed a much more cautious stance from policymakers despite last month's decision to lower rates for the second time this year.

Treasury yields and the dollar were higher early on Thursday, with the latter getting another lift from the ailing Japanese yen ahead of Friday's expected fiscal stimulus announcement.

The yen hit its weakest since mid-January, just shy of 158 per dollar, and is now in the zone where many suspect Tokyo may intervene to support it.

However, Japanese long-dated bonds continued to fall, with 30 and 40-year yields hitting new record highs and the 10-year at its highest since 2008 as Bank of Japan officials continue to signal a possible rate rise next month.

In Europe, there was attention on reports of another initiative to end the Ukraine war — which saw European defense stocks fall sharply on Wednesday.

These rebounded on Thursday however, as European countries pushed back on the U.S.-floated plan.

The euro zone's biggest bank BNP Paribas, meantime, jumped almost 6% on new capital projections and a buyback clearance. Back on Wall Street, the tech focus slightly obscured downbeat readings from the big retailers.

After Home Depot's miss earlier in the week, Target shares fell 3% on Wednesday on a large drop in sales as consumers cut back on discretionary spending. Walmart reports later today.

TODAY'S MARKET MINUTE

* Nvidia CEO Jensen Huang on Wednesday shrugged off concerns about an AI bubble as the company surprised Wall Street with accelerating growth after several quarters of slowing sales.

* The U.S. has signaled to President Volodymyr Zelenskiy that Ukraine must accept a U.S.-drafted framework to end the war with Russia that proposes Kyiv giving up territory and some weapons, two people familiar with the matter said on Wednesday.

* A big tech borrowing bonanza and signs of strain in private credit are spooking bond market lenders, in a trend that could move funding costs higher, hit corporate earnings and add stress to twitchy global markets.

* Conditions are ripe for a strong rally in the 'safe haven' Japanese yen. But the Japanese currency has been falling fast, calling into question its long-perceived role as a preferred hiding spot for spooked investors, argues ROI markets columnist Jamie McGeever.

* Stalled climate negotiations at COP30 and stubbornly high fossil fuel demand reflect the growing market consensus that the energy transition has slowed. But ROI energy columnist Ron Bousso argues that the risk now is that investors lose faith in a green shift that is continuing to move in one direction.

CHART OF THE DAY

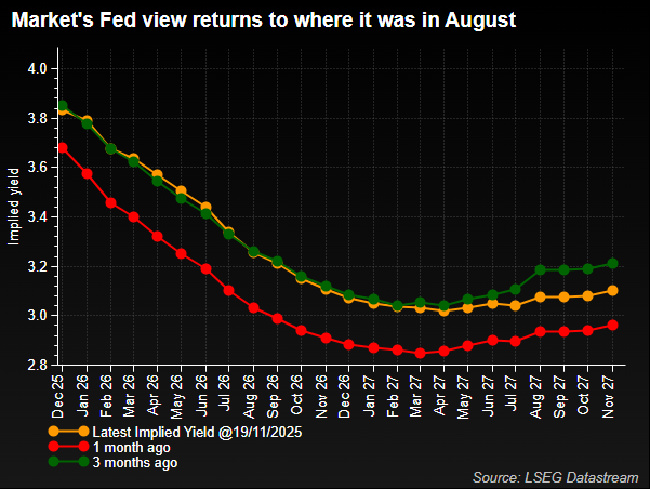

The market's view of the Fed's interest rate horizon over the next year has jumped back up about 25 basis points from where it was a month ago, with hawkish noises from regional

Fed officials and the absence of a November employment report before the next policy meeting in December all but removing any hope of another rate cut this year.

The Fed trajectory priced into the futures market has returned to where it was in August, before the Fed's last two rate cuts.

TODAY'S EVENTS TO WATCH

* US September employment report (0830) (all times EDT), weekly jobless claims (0830), Philadelphia Federal Reserve's November business survey (0830), October existing home sales (1000), Kansas City Fed's November business survey (1100), Canada October producer prices (0830)

* Federal Reserve Board Governors Stephen Miran, Lisa Cook and Michael Barr all speak, Cleveland Fed President Beth Hammack and Chicago Fed President Austan Goolsbee both speak; Bank of England policymakers Swati Dhingra and Catherine Mann both speak

* US corporate earnings: Walmart, Intuit, Copart, Jacobs Solutions, Ross Stores

* US Treasury sells $19 billion of 10-year inflation-protected securities

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

(By Mike Dolan; Editing by Aidan Lewis)

© 2025 Thomson/Reuters. All rights reserved.