Sky-high expectations left Nvidia shares in the red overnight despite another earnings beat from the world's most valuable company, as the market grumbled about slowing growth in core areas and ongoing geopolitical obstacles.

The chip giant’s shares were down about 2% ahead of Thursday's open. Doubts about the fate of Nvidia’s China business amid the U.S.-China trade war overshadowed the company’s outlook for a still whopping $54 billion of third quarter sales.

The firm said its outlook assumed no shipments of its H20 chips to China despite having received some licenses to sell them.

Ripples from the AI behemoth's share price stumble were limited across the global chip sector, with Nvidia boss Jensen Huang saying the artificial intelligence spending boom was far from over. And S&P 500 futures remained steady after a record close for the index on Wednesday.

Federal Reserve board governor Christopher Waller, tipped by many as President Donald Trump's pick for the next Chair and advocate of immediate Fed rate cuts, is due to speak later today with intensifying political pressure on the central bank the main focus.

With Fed futures pricing for a rate cut next month creeping back up toward 90%, two-year Treasury yields slipped further to four-month lows of 3.61% and two-year inflation-linked swaps closed in on 3% for the first time in three months.

Yields across the curve fell back too after a reasonable 5-year note auction, with the dollar under renewed pressure as China's offshore yuan surged to its highest levels of the year and Chinese stocks rallied.

Elsewhere, what's almost become an annual budget-related crisis for the French government — one that could see it collapse next month — smoldered but French and euro zone stocks rallied and 30-year French government debt yields fell back from Wednesday's 13-year high.

U.S. second-quarter GDP revisions and weekly jobless updates top the economic diary later, with more big retailers reporting earnings.

TODAY'S MARKET MINUTE

* Nvidia (NVDA.O) shares dipped on Wednesday as the fate of its China business hung in the balance, caught up in the trade war between Washington and Beijing.

* The U.S. government's new stake in Intel (INTC.O) is making some investors nervous that President Donald Trump's deal heralds an era of government meddling in private industry, particularly as the arrangement followed Trump's call for the resignation of the computer chip maker's CEO.

* Nvidia (NVDA.O) CEO Jensen Huang on Wednesday dismissed concern about an end to a spending boom on artificial intelligence chips, projecting opportunities will expand into a multi-trillion-dollar market over the next five years.

* European gas traders have faced a stressful race against the clock in recent summers as they have scrambled to refill depleted gas storage facilities ahead of winter. But, writes ROI energy columnist Ron Bousso, the continent’s traders and governments should have a lot more breathing room this year.

* Almost everyone agrees that overt politicization of monetary policy is dangerous. Why is that? ROI markets columnist Jamie McGeever’s provides five examples of where excessive political interference in central banking can lead.

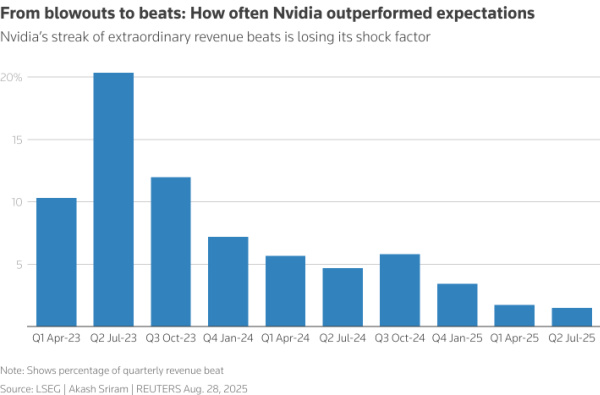

CHART OF THE DAY

Nvidia's stellar earnings beats are almost inevitably becoming less meaty. The chipmaker expects revenue of $54 billion, plus or minus 2%, in the third quarter, compared with average estimates of $53.14 billion.

But its fiscal second-quarter results came up short of some analyst expectations in its important data center segment, with some analysts suggesting cloud computing providers may be more cautious about spending.

Nvidia also said it has not assumed any shipments of its H20 chips to China in its outlook, despite having earlier this month received some licenses to sell them. If geopolitical issues subside and it gets more orders, Nvidia said it could add $2 billion to $5 billion in H20 revenue in the third quarter.

The overall picture sent its shares down 2-3% in after-hours trading, clipping about $110 billion from Nvidia's unrivaled $4.4 trillion market capitalization.

TODAY'S EVENTS TO WATCH

* U.S. Q2 GDP revision, Q2 corporate profits (8:30 AM EDT), weekly jobless claims (8:30 AM EDT), July pending home sales (10:00 AM EDT), Kansas City Fed's August business surveys (11:00 AM EDT)

* Federal Reserve Board Governor Christopher Waller speaks

* U.S. corporate earnings: Best Buy, Dollar General, Dell, Autodesk, Hormel Foods, Ulta Beauty, Brown-Forman

* U.S. Treasury sells $44 billion of 7-year notes

* 25th Franco-German Council of Ministers in Toulon

© 2026 Thomson/Reuters. All rights reserved.