While the media cycle and social media have been filled with talk of Trump’s tariffs, a lot of what you see is lacking nuance, incorrect, and even fearmongering.

First things first—are tariffs bad? Generally, yes, especially when combined with the income and sales taxes we already pay, many of which are hidden behind multiple layers of transactions before the end user pays for the end product or service made substantially more expensive by these taxes. In a tweet on X, Carol Roth pointed out that tariffs are widely regarded for having turned what could have been a mild recession into the Great Depression.

Before we get into the weeds, let’s talk about tariffs since many people do not seem to understand the concept. In a nutshell, a tariff is essentially a tax that our government charges another country to import its products into our country.

So what’s the big deal, you might wonder? The thought I see from many, especially on social media lately, is, “Another country has to pay for that, so it doesn’t affect me.”

Well, not so fast…

Tariffs are taxes, and consumers pay ALL taxes.

Yes, the countries we import from pay a price for the opportunity to sell their products and services in our country. But there is a cost to produce those products, and those countries need to profit from making and selling them, so guess what that means?

They’re simply going to increase the price of their products to offset the tariffs. (The same thing happens when the government raises taxes on corporations, but that’s a topic for another day.)

What this means to you is that prices of some products and services will go up. This is unavoidable.

How will this affect the cost of services when tariffs are placed on imported products? On the surface, it may not seem logical until you look at it from a business perspective. Many of the products affected by tariffs, including raw materials and energy, are necessary to run businesses entirely unrelated to those products. As the cost of goods sold, also known as COGS, increases, so do the prices those businesses need to charge to remain in business.

As a consumer, this means you will pay higher prices for a lot more than you probably realize.

Then why would Trump propose new tariffs?

This is a gut feeling, and it’s based on history and the data that I can see, but I think Trump’s threats of tariffs are most likely not what they seem.

If you’ve read his book, “The Art of the Deal,” you know he has a history of using misdirection to get what he wants in a deal, and I believe this is another example of that same strategy. Case in point—upon announcing his “plans” for new tariffs on Mexico, he brought President Claudia Sheinbaum to the table. He got her to agree to put 10,000 Mexican troops on their side of the southern border to help assist our efforts to secure it.

The same resulted in Prime Minister Trudeau of Canada and Columbia’s President Gustavo Petro readily buckling with Trump's threat of tariffs.

Think of it like a carrot-and-stick approach that makes other countries significantly more eager to negotiate with the U.S. It demonstrates strength.

And since his proposal, dozens of companies have announced they’re bringing manufacturing back to the U.S. to reduce the economic impact of tariffs on their profits, including Volkswagen, Samsung, Hyundai, LG, and Stellantis, to name just a few.

I suspect that we won’t actually implement these tariffs, though; if we do, they will be far lower than initially proposed. Time will tell.

What about the trade deficits?

This is an economic game of chicken, so whoever blinks first loses, and in that regard, the U.S. is in a unique position, at least when it comes to Mexico and Canada.

A staggering 83% of Mexico’s and 78% of Canada’s exports go to the U.S., while only around one-third of U.S. exports are destined for Canada and Mexico.

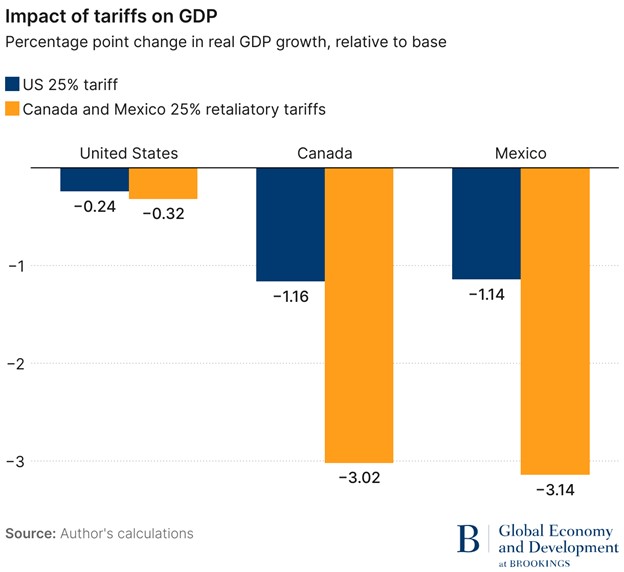

This means that while the economic impact of tariffs would be detrimental to all three nations, things will be a lot worse for Mexico and Canada for two reasons. The first is the trade deficit itself, but the bigger one is the difference in the size of our economies. Essentially, the U.S. can outlast them, making both countries far more likely to return to the negotiation table to make concessions in our favor.

But that doesn’t mean that if tariffs are implemented, it will be easy or pain-free for us. Any new tariffs will absolutely have an inflationary effect, making our already rocky economy even more unstable. And while the increased costs will be near instantaneous, if and when the tariffs are repealed, the inflationary effect will most likely remain at or near peak levels. We need to be prepared for the long haul because as I’ve been saying for years—the problems we’re facing took decades to create, and they likely will take decades to reverse.

What impact will tariffs have beyond inflation?

Inflation will be the first effect of the tariffs, but that will quickly ripple out into other aspects of the economy.

As a result of growing inflation, the Federal Reserve will be forced to raise interest rates to force it back down. This is a necessary step to turn the economy around, but it will also create significant financial pain because it will impact other aspects of the economy. Higher interest rates mean credit becomes more expensive, so big purchases like homes, cars, and commercial buildings, as well as the cost of business financing, to name just a few examples, will slow down.

That means job losses in multiple industries, leading to defaults on mortgages, auto loans, and credit cards, as well as reduced overall spending driven by a lack of income and reduced consumer confidence. It doesn’t take a PhD to see how this can quickly spiral out of control if not managed carefully. However, it can also start a local manufacturing boom, which could lead to a new golden age for the American economy and our status in the world.

What’s the right path?

The discourse on Trump's tariffs reveals a complex interplay between economic policy, international trade, and domestic consequences. While tariffs are traditionally viewed negatively due to their potential to exacerbate economic downturns and increase consumer costs, the strategy behind these proposals might extend beyond their apparent economic implications.

Trump's tariff threats could be interpreted as a strategic use of leverage, akin to the "carrot-and-stick" approach, aimed at securing better trade deals and encouraging foreign investment in U.S. manufacturing.

The immediate effects of any implemented tariffs would likely be inflationary, pushing prices up across various sectors due to increased costs of goods sold. However, this could also revitalize domestic industries, potentially fostering a new era of American manufacturing if managed with foresight and discipline.

The long-term impact on the U.S. economy remains uncertain. While tariffs could lead to job creation in manufacturing, the inflationary pressures might necessitate higher interest rates, potentially slowing down other economic activities and increasing the risk of recessions.

The balance between these outcomes will hinge on how policymakers navigate these waters, ensuring that the short-term economic pain leads to long-term gains. The ultimate goal should be to lay a solid foundation for future generations, ensuring economic stability and growth.

Whether tariffs serve as the right tool for this remains to be seen, but they undeniably underscore the need for nuanced economic policymaking.

_______________

Dr. David Phelps created Freedom Founders to help its members achieve the freedom they wanted in their lives by building the necessary financial foundation. He is a noted financial expert who is regularly cited by the media, and recently helped the FL Dept. of Education develop its new financial literacy curriculum.

© 2026 Newsmax Finance. All rights reserved.