U.S. Treasuries have been on the backfoot since the alarming U.S. producer price report last week, with 30-year bond yields holding just shy of 4.95% on Tuesday and the two-to-30 year yield curve gap firming above 117 basis points for the first time since January 2022.

With July housing starts on the diary later, along with a retail update from Home Depot, Fed futures currently price just over an 80% chance of a quarter point rate cut next month. Fed Chair Jerome Powell gives his keynote Jackson Hole speech on Friday.

S&P Global on Monday affirmed its 'AA+' U.S. sovereign credit rating and assigned it a stable outlook, saying the revenue from Trump's tariffs will offset the deficit hit from his recent fiscal bill and the budget gap would average 6% of GDP during the 2025-2028 period — down from 7.5% in 2024.

Wall Street stock futures were flat ahead of Tuesday's bell after ending little changed yesterday, with Chinese and Japanese stocks in the red earlier.

Palo Alto Networks forecast revenue and profit above estimates on Monday, betting on growing demand for its artificial intelligence-powered cybersecurity solutions — sending its shares up 5% in extended trading.

TODAY'S MARKET MINUTE

Intel is getting a $2 billion capital injection from SoftBank Group in a vote of confidence for the troubled U.S. chipmaker, and Nvidia is developing a new AI chip for China based on its latest Blackwell architecture that will be more powerful than the H20 model it is currently allowed to sell there.

U.S. President Donald Trump told President Volodymyr Zelenskiy on Monday that the United States would help guarantee Ukraine's security in any deal to end Russia's war there, though the extent of any assistance was not immediately clear.

Trump’s high-stakes diplomacy to resolve the war in Ukraine is unlikely to jolt oil and gas markets, no matter the outcome, writes ROI energy columnist Ron Bousso.

Consumer spending's surprising resilience is a key reason why the economy has not only avoided recession, but continued to grow at a solid clip. The big question now, writes ROI markets columnist Jamie McGeever, is whether American households can keep that going, especially with higher, tariff-fueled prices coming down the pike.

CHART OF THE DAY

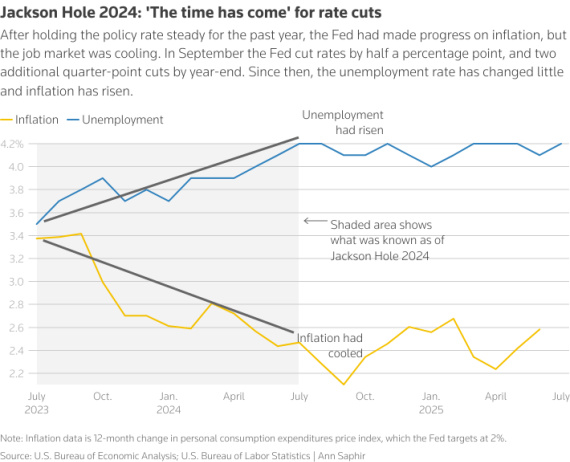

With Fed Chair Powell's speech at Jackson Hole on Friday watched closely for any signal about a resumption of Fed easing, the two key metrics on unemployment and inflation have changed little since the 2024 setpiece that flagged the first series of Fed cuts.

TODAY'S EVENTS TO WATCH

* U.S. July housing starts/permits (8:30 AM EDT); Canada July consumer prices (8:30 AM EDT)

* Federal Reserve Vice Chair for Supervision Michelle Bowman speaks

* U.S. corporate earnings: Home Depot, Medtronic, Keysight, Jack Henry

© 2026 Thomson/Reuters. All rights reserved.