This morning, markets are reacting to Moody’s rating downgrade of U.S. debt. For those promoting egregious amounts of “bear porn,” this is nirvana for fear-mongering headlines that gain clicks and views. However, as investors, we need to step back and examine the history of previous debt downgrades and their outcomes for both the stock and bond markets. Let’s start with what the Moody’s rating agency stated about its rating change.

“This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.”

Moody’s had been a holdout in keeping U.S. sovereign debt at the highest credit rating possible, and brings the 116-year-old agency into line with its rivals. Standard & Poor’s downgraded the U.S. to AA+ from AAA in August 2011, and Fitch Ratings also cut the U.S. rating to AA+ from AAA in August 2023. We will review these previous downgrades momentarily. However, the reason for Moody’s debt downgrade is unsurprising.

“Successive U.S. administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs. We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration.”

It is that last sentence that is the most important. Since 2008, the U.S. has not passed a single budget. Instead, Congress has repeatedly opted for short-term funding bills, known as Continuing Resolutions (CRs), which raised the debt ceiling and increased spending by 8% annually. (The “Rule of 72” says that at that rate, spending will double every 9 years) Such is why the national debt, specifically the deficit, has continued to grow unabated. Such was a point we discussed in Why $32 Trillion Matters.

“While Washington continues a seemingly unbridled spending spree under the assumption “more spending” is better, debts and deficits matter. To better understand the impact of debt and deficits on economic growth, we must know where we came from. The chart shows the 10-year annualized growth rate of the economy over time.“

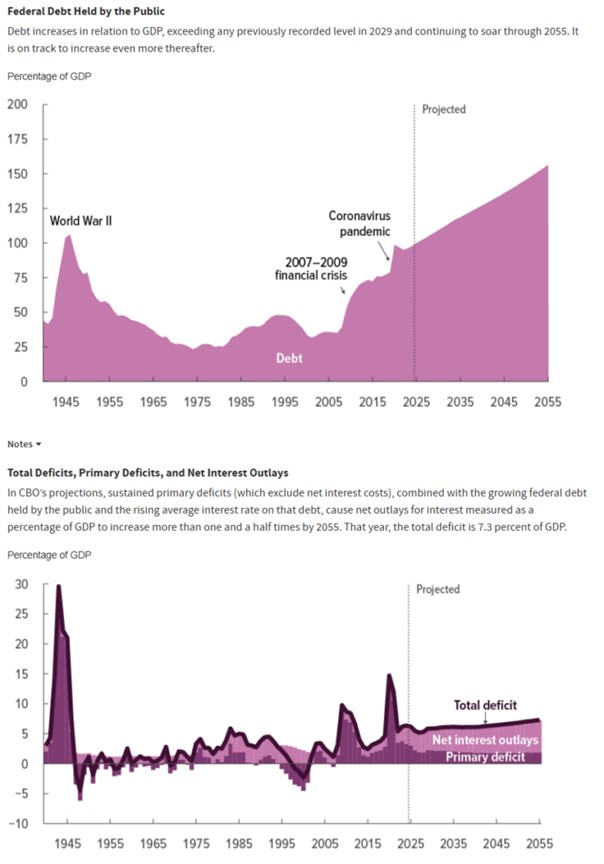

What should immediately jump out at you is that the 10-year average economic growth rate was around 8%, except for the Great Depression era, from 1900 through 1990. However, there has been a marked decline in economic growth since then. Unsurprisingly, as debts and deficits grow, the diversion of capital from productive activities to debt service erodes economic growth. That growth in debt is on a non-stop train to “Japanification,” where debt continues to rise, and economic growth is anemic. The Congressional Budget Office recently released its trajectory for U.S. debt levels through 2055, showing the same.

(The debt is also why interest rates can not rise to higher levels, which is a topic of an upcoming article on why we continue to buy Treasury bonds.)

While a debt downgrade is notable, there are several things that investors must consider.

- This is not the first time that U.S. debt has been downgraded. (We will review this momentarily.)

- The debt downgrade does nothing to impair the reserve currency status of the U.S. dollar.

- The U.S. Treasury remains the gold standard for “risk-free” investment for foreign and domestic savers.

However, most importantly, for investors, is the debt downgrade as ominous and bearish headlines suggest?

Let’s review previous history and see how stock and bond markets reacted.

S&P Downgrades US Debt

“Credit rating agency Standard & Poor’s on Friday downgraded the United States’ credit rating, stripping the world’s largest economy of its prized AAA status.

In July, S&P placed the United States’ rating on “CreditWatch with negative implications” as the debt ceiling debate devolved into partisan bickering. To avoid a downgrade, S&P said the United States needed to raise the debt ceiling and develop a “credible” plan to tackle the nation’s long-term debt.

In its report Friday, S&P ruled that the U.S. fell short: “The downgrade reflects our opinion that the … plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government’s medium-term debt dynamics.”

S&P also cited dysfunctional policymaking in Washington as a factor in the downgrade. “The political brinksmanship of recent months highlights what we see as America’s governance and policymaking becoming less stable, less effective, and less predictable than what we previously believed.” – CNN.Com

That action occurred on August 5th, 2011, as the Obama Administration faced Congress over the debt ceiling debate. Unsurprisingly, just as today, headlines were rampant with fearmongers ramping up the rhetoric about a dollar collapse, the economy’s demise, and the stock market’s collapse. While I am certainly not dismissing the issues with the debt buildup long-term, as noted in the linked article above, in the short term, history suggests there is much less to worry about in the near term.

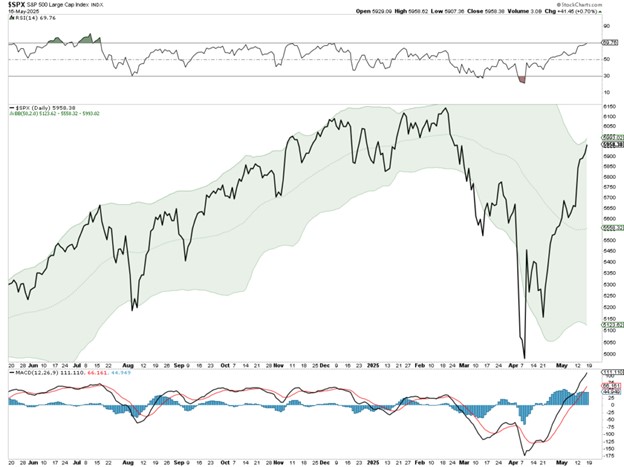

Let’s take a look at 2011 for a moment in charts. The first chart below is the stock market. As you will note, much like the advance we witnessed over the last few months, the market had rallied sharply from the lows in 2010 and was pretty overbought at the time of the debt downgrade. While prices did correct due to a combination of the manufacturing shutdown in Japan, a slowing U.S. economy, and the debt downgrade, that decline was a buying opportunity as the bullish trend continued into 2012.

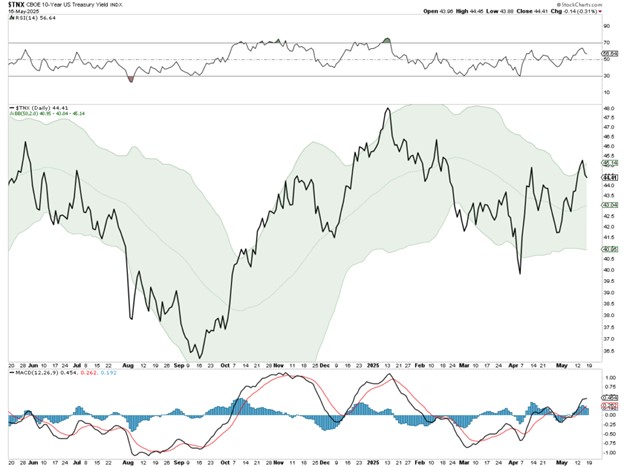

Likewise, in 2011, the yields on treasury debt also spiked higher temporarily as the debt downgrade shook investors. However, given that the U.S. treasury bond market remains the world’s preferred “safe haven,” yields declined into 2012. As is always the case, long-duration yields are a function of inflation and economic growth. The more debt issued, the slower the economic growth rate over time. Many “bond gurus” expect yields to spike sharply due to the need for debt issuance. However, the reality is that the economy can’t sustain higher rates because of the debt. What happened in 2011 will likely repeat itself in the months and quarters ahead as economic growth continues to slow.

What happened the second time?

Fitch Downgrades US Debt

On Tuesday, August 1st, 2023, almost exactly 12 years later, Fitch downgraded the U.S. credit rating.

“Fitch Ratings has downgraded the United States of America’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘AA+’ from ‘AAA’. The Rating Watch Negative was removed and a Stable Outlook assigned. The Country Ceiling has been affirmed at ‘AAA’.

What was Fitch’s reasoning for the downgrade?

“The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

Interestingly, the Treasury Department pushed back, saying the “analysis was flawed” in both cases.

“Janet Yellen, the US treasury secretary, said she disagreed with Fitch’s downgrade, in a statement that called it “arbitrary and based on outdated data.” – The Guardian

As with S&P’s debt downgrade, the reasons behind Fitch’s action were almost identical. They focused on the Government’s inability to deal with long-term debt issues.

However, as Yellen noted, the analysis is flawed on many levels. Such was a point made by Jamie Dimon, CEO of J.P. Morgan:

“It doesn’t really matter that much” because it’s the market, not rating agencies, that determines borrowing costs. Still, it’s ridiculous that other countries have higher credit ratings than the U.S. when they depend on the stability created by the U.S. and its military. To have them be triple-A and not America is kind of ridiculous. It’s still the most prosperous nation on the planet, it’s the most secure nation on the planet.”

While the long-term implications are dire, the near-term impact on various assets is much less concerning.

“The U.S. can print money and avoid default no matter how bad its fiscal position is. Accordingly, U.S. Treasury debt will still be considered the world’s only risk-free asset regardless of its ratings. The table below shows the market reactions to the S&P downgrade in 2011. Unexpectedly, bond yields fell appreciably, and the dollar rose, despite the downgrade. One would have thought gold would be a beneficiary. It was initially, but its price was slightly lower a year later. Stocks troughed 8% lower within the first week of the downgrade but were on solid footing afterward. Like twelve years ago, the downgrade may provide opportunities contrary to what many expect.“ – Michael Lebowitz

Much like in 2011, the stock market initially sold off on the news, but it was most driven by a reversal of the “Artificial Intelligence Trade” that had gotten ahead of itself. The debt downgrade had much less to do with the correction than providing a catalyst to reverse the overbought conditions that existed at the time.

The bond market also sold off initially with higher yields, but this quickly reversed. While yields are currently elevated due to stronger economic growth rates, higher inflation, and tighter Fed policy, that condition will reverse as continued debt increases weigh on financial prosperity.

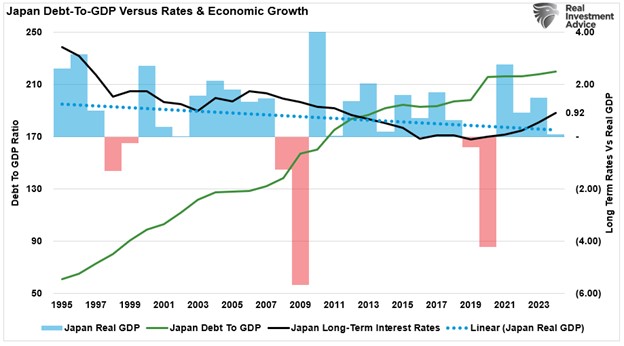

For evidence of such an outcome, we only have to look at Japan to understand the consequences of debt when it exceeds 100% of GDP. Since the 1980s, Japan’s economic trajectory has remained lower. Despite massive Government and central bank interventions, interest rates remain near zero percent as the economy experiences rolling recessions, plaguing overall prosperity. (As of the end of 2024, economic growth was barely positive with bond yields below 1%)

So the question facing investors is, should we care that Moody’s downgraded the debt?

Moody’s Downgrade – What It Means For Stocks & Bonds

With Moody’s debt downgrade, media headlines are running wild with speculation about what it means. As we have seen in the previous two downgrades, it has not meant much. Almost 15 years after S&P’s downgrade of the debt, the U.S. remains the world’s reserve currency, gold vastly underperformed equities, and the economy didn’t collapse under the weight of the debt. On the contrary, investors have been well rewarded betting against those outcomes.

However, is this time different? Most likely, the answer is “no.” Therefore, what should investors expect from stocks and bonds over the next several months following Moody’s downgrade?

Concerning the stock market, we went into the downgrade with stocks back in overbought territory after a significant advance from the “Liberation Day” lows. As shown, momentum and relative strength are overbought, especially momentum, with the market now two standard deviations above the 50-DMA. If you review the charts above, the market was in a very similar position during the previous announcements, leading to a short-term correction in equity prices.

As is always the case, when markets aggressively advance, it often takes an external, unexpected event to bring sellers into the market. Such would also be unsurprising if that were the case this time. However, most likely, such will be an opportunity for investors to add equity exposure.

Likewise, while not as overbought as equities, yields have pushed higher into the announcement. As seen in the previous two downgrades, yields did go higher on the news, but eventually, the fundamentals that drive yields (economic growth, wages, and inflation) reversed yields lower.

As we noted this past week, this is particularly true as US bank regulators prepare to reduce bank capital requirements.

“Of particular interest to the bond market is the supplementary leverage ratio, better known as SLR. Unlike other risk-based capital rules that banks adhere to, SLR applies a minimum capital requirement to all bank balance sheet assets. The rule was put in place in 2014 to limit excessive leverage. (More from the Office of Financial Research.)

Banks have long argued that the SLR handcuffs their ability to make loans. Furthermore, and of importance to the administration, banks claim that SLR limits their ability to buy Treasury securities. The article states that intense lobbying from Wall Street argues that SLR hinders competition and impedes lending. Remember that the eight largest US banks are subject to enhanced SLR, which are the biggest buyers of US Treasury securities.

Many analysts suspect that the SLR will change by this summer. However, the pressure to change them sooner could arise if Treasury yields continue to rise. With Treasury yields approaching 5%, we suspect banks will be licking their chops to buy Treasuries once the SLR restrictions are eased.”

Given the massive short position on U.S. Treasuries, bond buyers could see a significant drop in yields and a rise in bond prices, particularly if this coincides with the onset of a recession or Fed rate-cutting cycle.

Conclusion – Opportunity Likely Coming

It is crucial to remember that the US engages in deficit spending and issues debt in its currency, stimulating the economy and the private sector. As deficits increase, it adds net worth for households and corporations, which in turn end up as deposits at banks, which then see their reserves increase. Banks (the primary dealers) then swap these reserves for bonds at auctions, allowing the government to fund its deficits.

The Moody’s downgrade is meaningless in the longer term, as commercial banks, pensions, foreign governments, banks (collateral for repo operations), etc., are all, and will remain, demand buyers for Treasuries.

As with Janet Yellen previously, Scott Bessent was correct when he stated:

“I think that Moody’s is a lagging indicator. I think that’s what everyone thinks of credit agencies. Just like Sean Duffy said with our air traffic control system, we didn’t get here in the past 100 days. It’s the Biden administration and the spending that we have seen over the past four years.”

He is correct. Moody’s should have issued their downgrade when the deficit was running near $4 trillion following the pandemic shutdown, but issuing it after the deficit has been halved seems a little late.

From a portfolio management perspective, the debt downgrade does nothing to change our outlook. Investor demand and significant corporate share repurchases will likely continue to provide a bid under equities. However, we will not be surprised to see a pullback, which the media will quickly blame on Moody’s debt downgrade. However, given the short-term overbought conditions, the downgrade was the catalyst to bring sellers into the market.

Are we concerned about the potential for a recession or some financial event? Of course. Given the aggressiveness of the Fed rate hikes and tightening of lending standards, such an event is certainly possible. Economic growth is slowing, as inflation is falling, which is evidence of a slowing consumer. However, the market will provide advanced notice if we continue to pay attention to our technical indicators.

For now, the longer-term bullish trend remains intact. A correction that holds support and works off some of the overbought conditions will be a healthy outcome. Such will provide better risk/reward opportunities to increase stock and bond exposure.

Technical and sentiment readings suggest the market has gotten ahead of itself, so investors should consider rebalancing portfolio risk accordingly.

- Tighten up stop-loss levels to current support levels for each position.

- Hedge portfolios against more significant market declines.

- Take profits in positions that have been big winners.

- Sell laggards and losers.

- Raise cash and rebalance portfolios to target weightings.

Of all the things investors should worry about, the Moody’s debt downgrade is not one of them.

_______________

Lance Roberts is a Chief Portfolio Strategist/Economist for RIA Advisors. He is also the host of “The Lance Roberts Podcast” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter, Linked-In and YouTube.

© 2026 Newsmax Finance. All rights reserved.